After months of U.S. home prices rapidly accelerating, new figures show the growth is slowing — not that bargain hunters are ready to whip out their wallets.

U.S. home prices rose 19.8 percent year-over-year in August, after July’s 19.7 percent annual increase, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index. The leveling off comes after four straight months of record-setting, increasing growth.

“August data also suggest that the growth in housing prices, while still very strong, may be beginning to decelerate,” said Craig Lazzara, managing director and global head of index investment strategy at S&P Dow Jones Indices.

Buyers should be wary, index co-creater Robert Shiller wrote in Project Syndicate Monday. Purchasing in booming locations may not be a safe long-term bet, he said.

“Even at currently elevated U.S. home-price levels, buying still makes sense for those who are set on ownership,” Shiller wrote. “But buyers need to be sure that they can accept what could be a rather bumpy and disappointing long-term path for home values.”

Read more

News

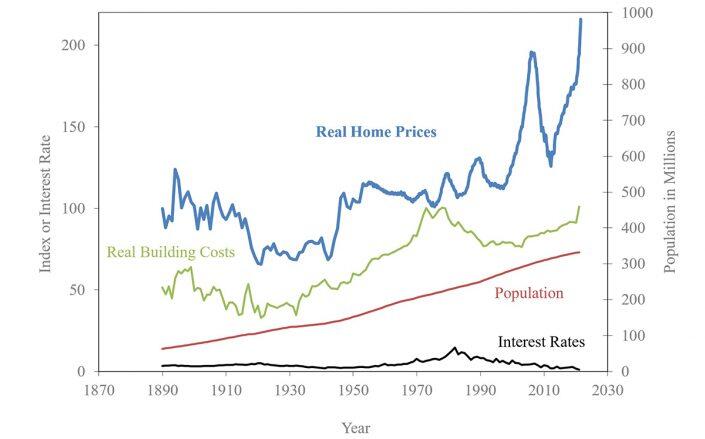

The bursting of the housing bubble that triggered the Great Recession saw national home prices fall 36 percent from December 2005 to February 2012. (They have since risen 71 percent.) But that isn’t the only example of declining home values.

Shiller cited data that showed that U.S. home prices, adjusted for inflation, were often lower in the 1990s than they were a century ago. The drop came as cities spread out to cheaper land and homebuilding technology improved.

For buyers and sellers focused on today, the August pause in price-growth acceleration was similar across two other Case-Shiller indices: the 10-city composite, which rose by 18.6 percent, and the 20-city composite, which rose by 19.7 percent. Both figures were less than their July gains.

Experts credit the market’s rise in part to buyers’ response to the coronavirus pandemic as they migrated from urban apartments to farther-out homes. More data is needed to determine if the demand surge is attributable to households advancing their homebuying plans — causing purchases to bunch up — or to changes in location preferences.

Phoenix and San Diego saw the highest year-over-year gains in home prices in August, increasing by 33 percent and 26.2 percent, respectively. Tampa replaced Seattle at No. 3, with prices increasing by 25.9 percent.

Price growth was strongest in the Southwest, though every region saw double-digit gains.

Case-Shiller’s national index is 45.5 percent higher than its previous peak in July 2006. Only eight of the cities in the 20-city index reported higher year-over-year price increases in August than in July.