S & A Retail, responsible for the United States operations of Italian footwear brand Geox, has reportedly agreed to pay $8.8 million in back rent and other fees to Sutton’s Wharton Properties.

The agreement was discovered in documents posted to the Tel Aviv Stock Exchange, according to the Commercial Observer.

In July 2020, S & A filed a lawsuit against Wharton that alleged the lease was “frustrated” by the pandemic, which knocked down foot traffic in the area and forced the store to temporarily close. Wharton denied the suit’s claims.

S & A filed for bankruptcy in March. The Commercial Observer reports that the company missed $4.5 million in rent payments at its Garment District retail outpost. It has already paid $7.8 million to Wharton Properties and is due to pay another $1 million.

Geox entered into a 15-year lease at the store in 2007. Court records show base rent for the lease was $2.6 million in 2020, according to the publication.

Read more

The agreement with Wharton puts an end to S & A’s lease at 29 West 34th Street. Geox no longer has an outpost in New York City, although the brand’s shoes are sold by other retailers.

The pandemic prompted many retailers to stop paying rent at locations across the country. As the global health crisis crept towards its one-year mark, many landlords turned to lawsuits to recoup months of missing payments.

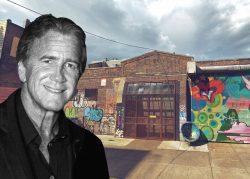

When Wharton Properties isn’t collecting back rent on retail properties, as of late, it appears to be selling them. In late September, the company sold a 17,000-square-foot retail building at 2917 Nostrand Avenue in Sheepshead Bay, Brooklyn, along with an adjacent parking facility. An LLC known as 2918 Nostrand purchased the properties for $18 million.

[CO] — Holden Walter-Warner