Trending

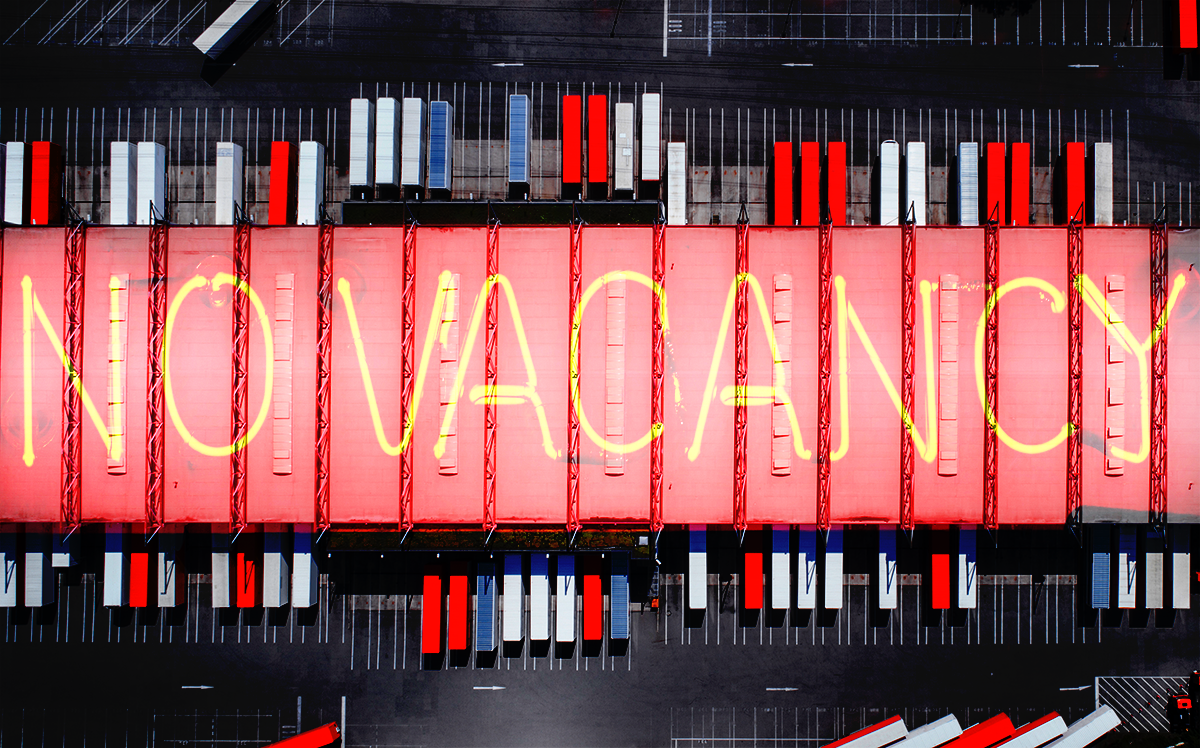

No vacancy: New Jersey warehouse space effectively sold out

Supply struggles to meet insatiable demand across Northeast as NJ Class A vacancy dips to 0.2%

New Jersey’s warehouse market may as well put up a “No Vacancy” sign.

Demand for prime warehouse space in the Garden State is so strong that the vacancy rate for Class A properties is down to 0.2 percent — essentially sold out — according to a report from JLL.

Industrial developers in the Northeast can’t build quickly enough to meet surging demand from the rise in e-commerce and the ripple effects of the pandemic.

Even though warehouse construction in the region is outpacing its five-year average by 80 percent, nearly half of that space is already preleased, according to JLL.

“These elevated construction levels still aren’t enough to satiate demand,” the report read. “Given the record low vacancy rates and strong preleasing volumes, tenants have begun to understand the new reality of the market, as they must plan much further in advance in order to secure the space they need.”

The Northeast region, which includes New York, New Jersey, Pennsylvania and Delaware, is the largest warehouse market in the country, encompassing 1.75 billion square feet. The vacancy rate for the region stood at 2.5 percent in the third quarter, with average rents clocking in at $9.21 per square foot.

As tenants invest in their supply chains to meet booming consumer demand, the frenzy over warehouse space is not confined to the Northeast.

Prologis, the country’s largest warehouse landlord, said on an October earnings call that its global portfolio was 98 percent leased and 97 percent occupied during the third quarter.

The nationwide industrial vacancy rate fell to an all-time low of 4.1 percent during the third quarter, while average rents reached a record $7.18 per square foot.