The majority stake in bankrupt Jeff Winick’s namesake brokerage has sold to the highest bidder, but the IRS is less than satisfied with the result.

A group of Winick Realty Group insiders walked away from a bankruptcy auction Tuesday with a 63 percent stake in the firm, sources told The Real Deal. Louis Eisinger, Lee Block and Steven Baker — who sources say is already a 10 percent partner in the brokerage — were selected as stalking horse bidders, setting the original bid at $310,000. It’s unclear how much the group ended up paying.

The proceeding was not without controversy. On Monday evening, less than 24 hours before the auction was to commence, U.S. Attorney Damian Williams submitted a letter on behalf of the IRS to the bankruptcy judge overseeing the sale, raising concerns over the apparent late inclusion of Winick’s daughter Danielle Winick Lapidus, an executive vice president at the brokerage, as part of the stalking horse bid.

Under the agreement between Winick Lapidus and the other bidders, Williams wrote, Eisinger, Block and Baker would receive 36 percent of the Winick stake up for bid, while Lapidus would walk away with “the lion’s share,” 48 percent. Two other previously undisclosed bidders would get 16 percent, according to Williams.

“The last-minute inclusion of Danielle Winick Lapidus in the WRG insiders’ bidding group raises questions about whether that bidding group can establish that they are good-faith purchasers of the Winick Interests,” Williams wrote. “Danielle Winick Lapidus’ involvement contradicts the plain terms of the sale agreement entered into by the WRG insiders over a month ago.”

Williams speculated that the group may have intentionally concealed Winick Lapidus’ involvement in order to secure their selection as the stalking-horse bidder.

Williams noted that the government is not making any allegations of impropriety, but is asking the court to look into the timeline of the arrangement between the stalking-horse bidders and Winick Lapidus. A hearing on the sale is scheduled for Thursday, Nov. 18.

The auction house, Maltz Auctions, declined to comment. Winick, Winick Lapidus, Eisinger, Block and Baker did not immediately respond to requests for comment.

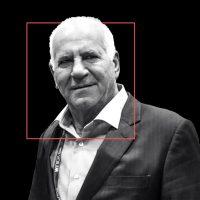

Once one of New York’s top retail brokers, Jeff Winick filed for personal bankruptcy a year ago, claiming he owed $9.7 million in back taxes and had just $530,000 in assets. The IRS filed a lawsuit against him in May, alleging that he was rearranging his assets to avoid paying his debts.

Though Winick was poised to lose a majority stake in his brokerage, sources told TRD last month that he remains an active dealmaker, listed as an exclusive agent on many of his namesake brokerage’s listings.

It’s not the first time others have owned pieces of Winick’s brokerage. The late Stanley Chera and Lloyd Goldman paid $1 million for a 50 percent stake in Winick Realty Group in 2002. They no longer own a stake in the firm.

Read more