In “Mallrats” — the quintessential movie about ’90s mall culture — a character is driven mad trying to find a sailboat hidden in a Magic Eye poster.

Assessing the state of American malls today can trigger the same frustration.

Three of the country’s largest mall landlords — all coping with similar problems even before Covid shuttered their doors last year — went into bankruptcy during the pandemic. But the trio emerged from their restructurings with wildly different outcomes, in some ways leaving more questions than before.

Some experts chalk up the divergent results to the companies’ ability — or lack thereof — to steer their properties toward relevance. How intact a mall owner comes out of the process depends on how much faith creditors have in its vision.

“It represents the investors’ belief in the likelihood of success,” said Michael Haas, co-head of the real estate group at the law firm Latham & Wakins.

The three mall owners — Pennsylvania Real Estate Investment Trust, CBL & Associates Properties and Washington Prime Group — were already flirting with bankruptcy prior to 2020.

Malls, especially the B- and C-quality properties that the three specialize in, were losing business to internet retailers and newer, higher-grade shopping centers. The pandemic just pushed them over the edge.

Pennsylvania REIT, which owns 20 shopping malls concentrated in the Mid Atlantic region, was the first of the three to enter bankruptcy, a year ago last November. It was relatively quick: In a little more than a month, the company reorganized and effectively kicked the can down the road.

Instead of reducing what it owed, as many companies do through bankruptcy, PREIT took on $150 million more debt and pushed back its maturity dates. But its equity investors were allowed to keep their stakes.

Read more

One explanation for the relatively painless process is that the company’s reimagining of its portfolio was well underway when Covid arrived.

“It was one of the first to be really aggressive trying to divest itself of those lower-performing properties,” said Carmen Spinoso of Spinoso Real Estate Group, which invests in and manages struggling malls. “They were ahead of the curve a bit.”

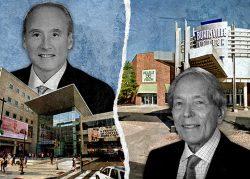

Next into Chapter 11 was CBL, which owns 44 malls in the Southeast and Midwest.

It also filed that November but only exited bankruptcy last week. The company reduced its debt by about $1.7 billion as investors handed over ownership to bondholders.

CEO Stephen Lebovitz called it a “fresh start” and said CBL is focused on shoring up its balance sheet.

“While the restructuring reduced overall interest expense significantly, a major priority is to continue to lower borrowing costs and enhance cash flow,” he said in a statement last week.

The last to enter bankruptcy was Washington Prime Group, which underwent the most drastic restructuring of the three.

The owner of 101 properties across the country filed for Chapter 11 protection in June. When it came out four months later the REIT was in the hands of distressed debt investor Victor Khosla’s Strategic Value Partners.

Washington Prime CEO Lou Conforti stepped down and Khosla de-listed the REIT from the New York Stock Exchange, taking it private.

Observers said Washington Prime’s portfolio may see the greatest overhaul, with properties being redeveloped or sold off.

“As a privately held company, there might be a bit less scrutiny and a little bit more flexibility,” Latham’s Haas said.

Bankruptcy and mall experts noted that the three restructurings might have less to do with the properties and more with the REITs’ ownership structures — whether debt investors could get enough control of a company to throw their weight around in bankruptcy.

The three companies are now preparing for Act II as they head into the crucial holiday shopping season and the post-Covid future.

Terrence Grossman, a director at the turnaround consulting firm AlixPartners, said mall landlords face the same strategic issues as before the pandemic. That is, trying to re-imagine their properties in a world of fewer retailers with fewer stores to occupy their malls.

“Even though the capital structures may be more conservative out of bankruptcy,” he said, “the real issue is making the economic model work, given the disruption and changing dynamics in the retail industry.”