Manhattan office market records busiest month since start of pandemic

Manhattan office market records busiest month since start of pandemic

Trending

Manhattan office leasing breaks 3M sf barrier for first time since early 2020

Still a long road ahead to reach pre-pandemic levels

Manhattan’s office market recovery continued last month, even as Covid levels rose in many parts of the state.

Office tenants in Manhattan signed more than 3 million square feet of leases in November, the first month to exceed that mark since January 2020’s 3.6 million, according to Colliers’ monthly market snapshot.

To put that into perspective, Manhattan’s monthly office leasing volume in 2019 was about 3.5 million square feet on average, while the 2020 monthly average was about 1.5 million, said Franklin Wallach, Colliers’ senior managing director for New York research.

The November leasing volume was up 14.8 percent from October, and more than four times the volume recorded a year ago.

The year-to-date leasing total stands at 22.13 million square feet, up 27.4 percent compared to the same period in 2020. But it is 41.1 percent lower than the 2019 level.

“Leasing volume has certainly picked up compared to 2020, but there’s still a significant road ahead in terms of catching back up to the pre-pandemic leasing volume,” Wallach said.

Read more

Manhattan office market records busiest month since start of pandemic

Manhattan office market records busiest month since start of pandemic

First tenant at Olayan Group’s 550 Madison takes 240K sf

First tenant at Olayan Group’s 550 Madison takes 240K sf

MSG Entertainment re-ups at Vornado's 2 Penn for 428K sf

MSG Entertainment re-ups at Vornado's 2 Penn for 428K sf

The availability rate in November was 16.9 percent, down 0.1 percentage points from October. The rate is still 3.4 percentage points higher than a year ago.

Average asking rent for the month was $74.14 per square foot, up 0.7 percent from October.

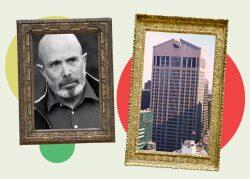

The largest lease inked during the month was MSG Entertainment’s new 428,000-square-foot lease at Vornado Realty Trust’s 2 Penn Plaza in Midtown South, followed by insurance firm Chubb’s 242,000-square-foot lease at Olayan Group’s 550 Madison Avenue in Midtown.

The third biggest lease was Dechart’s 241,000-square-foot renewal at 3 Bryant Park, a 41-story skyscraper owned by a partnership between Ivanhoé Cambridge and Callahan Capital Properties.

Net sublease availability in November was 19.46 million square feet, a reduction of 370,000 square feet from October, continuing the downward trend that started four months ago. But the total sublease inventory is still 63.5 percent greater than the March 2020 level.

Manhattan’s overall availability has increased by 68.6 percent since March 2020 to a total of 90.81 million square feet, and more blocks of offices are expected to come online in the coming months, including 60 Wall Street, which is being vacated by Deutsche Bank. The bank moved its headquarters to a 1-million-square-foot space at the former Time Warner Center, now known as Deutsche Bank Center, in Columbus Circle.