Rexford’s latest splurge: $107M for four new properties across SoCal

Rexford’s latest splurge: $107M for four new properties across SoCal

Trending

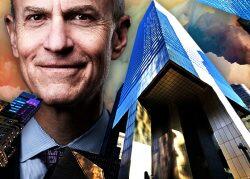

Tishman Speyer buys pair of industrial assets in diversification play

Office giant acquires distribution centers in Colorado, Pennsylvania under new $500M co-investment platform

Tishman Speyer is getting in on the industrial gold rush.

The developer behind some of the world’s most recognizable office towers has teamed up with South Korea-based Hana Financial Group and Vestas Investment Management to acquire two U.S. industrial facilities as part of a new $500 million coinvestment platform, which the firms say will target a range of assets and global markets.

Tishman will manage the two properties through a new in-house industrial platform.

The assets are fully leased, class A facilities, but they are far from the gleaming urban centers where Tishman has built its empire. Tishman called them “middle-mile” distribution centers. One, at 4333 Integration Loop in Colorado Springs, Colorado, is 279,000 square feet. The second, at 17 William Drive in Allegheny County, Pennsylvania, about five miles from Pittsburgh International Airport, is 278,000 square feet.

The seller was SunCap Property Group, which developed both properties. Terms of the deals were not disclosed.

Industrial real estate boomed during the pandemic as the consumer economy moved significantly online. Today, it is perhaps the strongest performing commercial real estate segment, with record-low vacancies in many markets. Recent supply chain dislocation has only heightened demand, particularly for so-called last-mile facilities close to consumer bases.

Tishman CEO Rob Speyer framed the acquisitions as “another milestone” in the office developer’s ongoing diversification. The company was drawn to the properties’ strategic locations and the quality of both their construction and their leases, he said in a release.

Tishman couldn’t be immediately reached for comment.

On the other side of the commercial spectrum, office properties, along with retail, have been among the hardest-hit asset classes over the last 18 months, as white-collar workers fled urban centers for the suburbs and flexible work policies took the air out of even the tightest office markets.

Other office-centered New York landlords have diversified their holdings in recent months, including Empire State Realty Trust, which ventured into the multifamily market — another relatively hot commercial segment — to hedge against weakness in the office sector.

On Tuesday, TRD reported that Tishman was in contract to acquire eight multifamily development parcels in Santa Monica, California, for nearly $150 million. And last month, the firm purchased 10 of the 11 building sites that will make up Edgemere Commons, a planned 2.2-million-square-foot affordable housing development in Far Rockaway, Queens.

Read more

Rexford’s latest splurge: $107M for four new properties across SoCal

Rexford’s latest splurge: $107M for four new properties across SoCal

Boston Properties nabs $1B loan at 601 Lex

Boston Properties nabs $1B loan at 601 Lex