A new real estate intelligence platform wants to give institutional investors a heads-up on hot housing markets while the fervor is still only a whisper.

Haystacks.AI says it can give institutions an edge by layering alternative information like sentiment data, culled from sources like Yelp reviews, on top of primary structured real estate data.

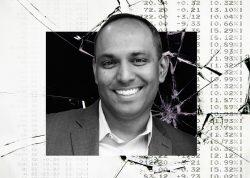

“Alternative data has never really been incorporated into real estate decision-making, largely because it was difficult to collate,” co-founder and CEO Sourav Goswami told The Real Deal.

Haystacks was founded in early 2021. Earlier this month, the company raised $5 million in a seed round led by Streamlined Ventures and Colle Capital to accelerate product development. Adit Ventures also participated in the round alongside several prominent individuals within the real estate industry.

The world has become more narrative-driven, and detecting early shifts in how homeowners and prospective homebuyers perceive cities and specific neighborhoods — even specific blocks within them — can help institutional investors better meet target yields, Goswami said.

Read more

“This consumer narrative is driving companies to make decisions on where they want to hire, and where they want to open new restaurants and entertainment venues,” Goswami said.

Haystacks purchases or licenses alternative data from a range of aggregators and also identifies unique data itself. For now, the platform is focused only on the single-family home market, which Goswami described as at a “unique inflection point.”

“It’s becoming much more institutional,” he said of the single-family market. “Yet the data is fairly opaque because it’s largely self-reported and largely populated by information from local brokers.”

Goswami’s long career in real estate has involved stints at Goldman Sachs, Merrill Lynch and Walton Street Capital, among other firms, but Haystacks is his first proptech venture. The company developed its platform collaboratively with a range of real estate industry insiders, which Goswami deems essential to the startup’s success.

Real estate operates significantly on trust, Goswami said, making it difficult for outsiders to fully comprehend the industry’s challenges, and therefore, properly engineer tech to resolve them.

“Real estate is resistant to moving fast and breaking things, but it’s very open to evolution,” he said.