The holiday spirit was audible outside Steve Croman’s Upper East Side mansion Thursday night, but the carolers weren’t singing “Jingle Bells.”

As members of the Stop Croman Coalition, a tenant group formed in 2007 to hold the notorious landlord accountable, set their feelings about him to music, a colorful rewrite of “You’re a Mean One, Mr. Grinch,” stood out:

“You’re a demon, Mr. Croman.

You are a devil from Hell.

You’re the Bernie Madoff of landlords

And a slumlord as well

Mr. Croman…”

The song served as an introduction for state Sen. Brad Hoylman, who came bearing a legislative gift: a bill that would bar landlords convicted of fraud or violating housing laws from receiving financing from state-chartered banks.

The goal of the proposed legislation, Hoylman said, is to stop bad actors like Croman from buying additional buildings and subjecting more tenants to harassment.

“[They] will not be handed more money to grow their evil empires and take advantage of even more New Yorkers,” he said.

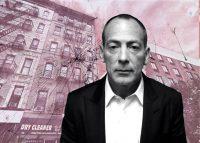

Croman has for years been criticized for his alleged predatory treatment of tenants.

He spent eight months in jail after pleading guilty to grand larceny and tax fraud in 2017, and agreed to pay $8 million to settle claims he harassed tenants out of rent-regulated apartments. As part of the settlement, temporary control of his more than 100 properties was turned over to Michael Besen’s NYC Management until 2023.

But in the years following his release, critics say Croman has reprised many of his old tactics.

The Real Deal reported in 2019 that the infamous landlord had jumped back into the city’s real estate market, acquiring new buildings and popping in to give orders to supers at his existing properties, despite the five-year ban that purportedly prevents him from managing his portfolio.

Tenants told TRD they still experienced abuse under NYC Management, which had hired Croman’s former employees. Croman also faced new lawsuits for allegedly backing out of deals and illegally deregulating units.

The legislation would bar Croman from receiving financing from major multifamily lender New York Community Bank, which has continued to lend to the landlord despite being one of the banks he was convicted of defrauding.

Excluding construction loans, the city’s three largest commercial real estate lenders — Wells Fargo, JPMorgan Chase and Deutsche Bank, according to TRD’s 2019 ranking — are each federally chartered, and thus would not be impacted by the measure. NYCB and Signature Bank, fourth and fifth on the list, respectively, are state banks that would be affected by the bill.

Hoylman, who claimed at the rally that tenants in some of Croman’s buildings lost their heat last month after the landlord stopped paying his bills, said he hoped the ban would send a message that the state will not tolerate harassment.

“Hopefully non-state chartered financiers will think twice before lending to known slumlords,” he said. Croman did not respond to a request for comment.

Responding to the suggestion that the legislation could constitute a form of double jeopardy for property owners who paid for their crimes with time behind bars, Hoylman said state-chartered banks simply shouldn’t be aiding and abetting notorious landlords like Croman.

The Conference of State Bank Supervisors, a national organization that supports regulators overseeing state banks, did not comment in time for publication.

A spokesperson for The Real Estate Board of New York said the trade group, which represents property owners, was reviewing the legislation.

The bill will be on the table when the state legislature returns to Albany in January. Until then, the Stop Croman Coalition will be “dreaming of a warm Christmas…”

“Just like the ones I used to know

We had heat and hot water

And all the things we oughta

Before Steve Croman came along.”

Read more