Oceanwide creditors seize SF project after missed debt payment

Oceanwide creditors seize SF project after missed debt payment

Trending

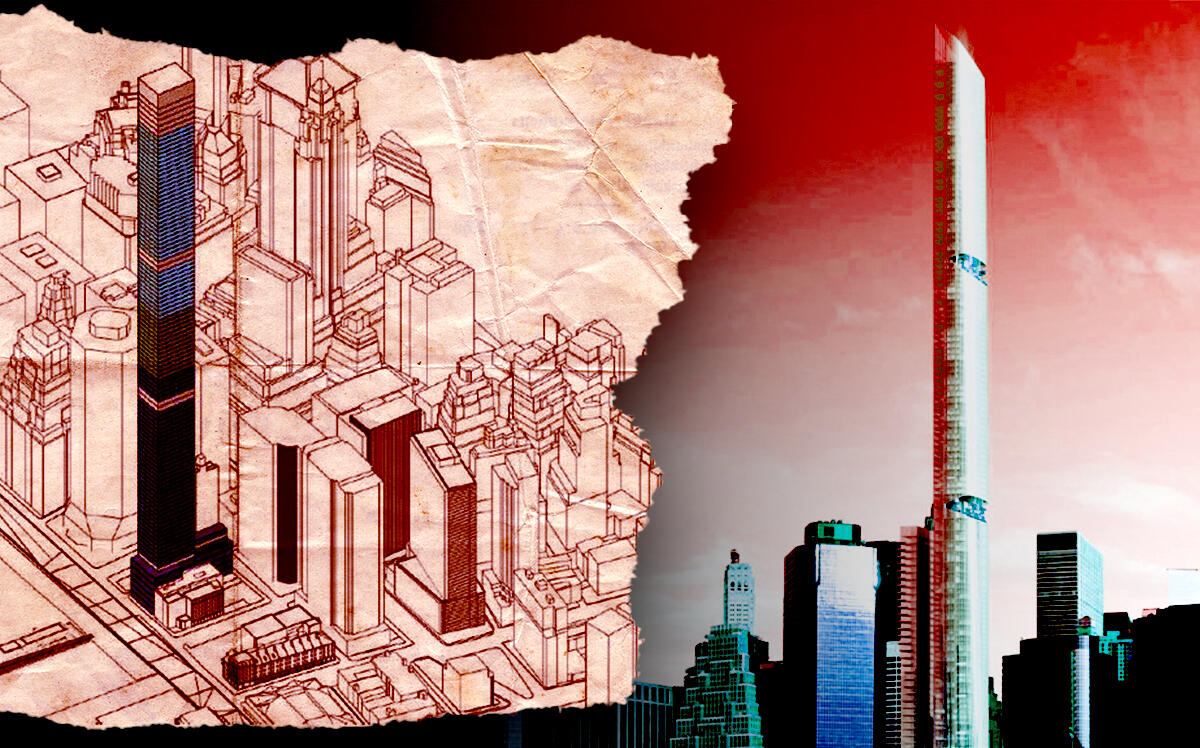

Chinese developer defaults on $175M loan for languishing Manhattan supertall site

DW Partners demanding $165M from Oceanwide Holdings

One of China’s largest companies has taken another hit on its pricey development site in Manhattan’s South Street Seaport.

Oceanwide Holdings defaulted on its $175 million loan against 80 South Street, where a planned skyscraper has been stalled for years, Bisnow reported. The loan was taken out against the property in 2019, while Oceanwide was trying to sell it.

The loan — believed to be the only debt against the property — was set to mature in May 2021, before DW Partners granted Oceanwide a six-month extension. When November rolled around, the debt matured. Bisnow reported Oceanwide missed a $1.3 million payment earlier this month, and DW Partners is demanding an immediate payment of the outstanding $165 million loan.

The company’s efforts to sell the site have been unsuccessful. As of October, Oceanwide was looking to get about $200 million for the site, sources told The Real Deal. That’s only slightly more than half of the $390 million Oceanwide paid for the site in 2016.

Since purchasing the site, Oceanwide has struggled with its debt after making billions of dollars in investments stateside.

Read more

Oceanwide creditors seize SF project after missed debt payment

Oceanwide creditors seize SF project after missed debt payment

Chinese developers in US struggle as Evergrande mess threatens business back home

Chinese developers in US struggle as Evergrande mess threatens business back home

The company had aspirations of building the tallest tower in Lower Manhattan by roof height, to top out at about 1,500 feet. Renderings seen in 2019 showed a glass-heavy tower taking shape in the downtown skyline.

But the plans never fully materialized and Oceanwide quietly began marketing the property in 2019 with Cushman & Wakefield, seeking $300 million. A Colliers International team led by Peter Nicoletti is currently in charge of marketing the property.

Oceanwide has been struggling with about $3.5 billion of investments, including a San Francisco site that was expected to become the city’s second-largest tower. Debtholders in October seized Oceanwide Center, which struggled with failed sales, $1.6 billion in costs and more than $40 million of mechanic’s liens.

The company previously crossed all of the “three red lines” the Chinese government created to get developers to deuce debts.

[Bisnow] — Holden Walter-Warner