The U.S. office market has shown some promising signs of recovery in the wake of the pandemic, but landlords are taking larger hits than ever before to complete the big-ticket deals.

Cash incentives and months of free rent are helping to prop up the national office market, The Wall Street Journal reported. These incentives range from cash payments to tenant improvements and money for construction projects.

CBRE reported cash payments made to tenants in the Manhattan office market have more than doubled from 2016 to 2021, from $76 per square foot to $154 per square foot, for the market’s most expensive leases.

According to CBRE data reported by the Journal, landlords were collecting 7.7 percent less on these leases in the same five-year period, despite official rents increasing 1.6 percent. In 2021, CBRE reported the average rent in Manhattan for offices charging at least $100 on the face was $128 per square foot; after incentives, that dropped down to $84 per square foot.

Despite the initial hit from floating the incentives, landlords benefit by having high rents on paper to inflate the value of the property and perhaps lure other tenants.

Read more

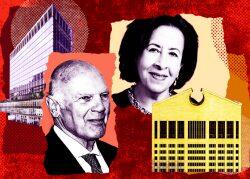

A recent lease signed in Times Square serves as a microcosm for the larger market. Digital media manufacturer Roku recently agreed to a long-term lease for 240,000 square feet at RXR Realty’s 5 Times Square. The company expects to move into the space by the fourth quarter.

However, the deal contains a catch for RXR. According to the Journal, the company is receiving more than $30 million for construction work, in addition to a rent-free period lasting anywhere from 18 to 24 months. Those incentives severely diminish the asking rent, which was north of $90 per square foot.

Details on the share of incentives in office leases comes after CBRE data published earlier this month showed 105 contracts signed for spaces priced at or above $100 per square foot in Manhattan in 2021. That figure marked a 114 percent year-over-year increase and an 18 percent rise from a five-year average.

[WSJ] — Holden Walter-Warner