A national hotel investor is choosing to cut its losses at a Holiday Inn in Chelsea rather than wait for the city’s hospitality sector to recover.

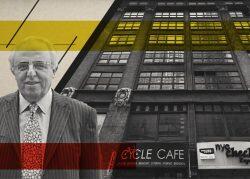

Watermark Capital is exploring a sale of the 226-key hotel at 125 West 26th Street, between Sixth and Seventh avenues, Crains reported. The investment firm has owned the building since 2013, when it purchased it from Magna Hospitality for $113 million.

The hotel has managed to stay open for most of the pandemic, but has struggled to make up for lost revenue. After sporting an average occupancy rate of 92 percent in 2019, it was only 54 percent occupied as of the fall, and its cash flow had turned negative, according to Crains.

Watermark fell behind on its mortgage payments in October 2020 and the loan was transferred to a special servicer in January of last year, according to the publication. At the time, the property’s value was appraised at $78.4 million, slightly more than its $72 million loan.

So far, the firm has avoided foreclosure by negotiating with its lender. It’s not clear how much it is seeking in return for the property; the buyer would likely need to assume the balance of Watermark’s loan.

Despite uncertainty over the future of the city’s hospitality sector, there appears to be a market for its struggling hotels.

Last month, John Young’s Emmut Properties bought the shuttered Excelsior Hotel on the Upper West Side for $80 million. Emmut has not revealed its plans for the property, but the firm specializes in converting buildings into rental complexes.

That same month, Apple Core Holdings sold the shuttered Hotel at New York City in Murray Hill for an undisclosed price to Prem Jyotish. The building is set to be converted into transitional housing for the homeless in partnership with the Bowery Residents’ Committee.

Under a law passed by the City Council in September, hotels that closed entirely or laid off 75 percent of their staff during the pandemic must either reopen or provide severance pay to their out-of-work employees for up to 30 weeks.

The Hakimian Organization recently filed plans to change a 113,000-square-foot Midtown project from hotel to mainly residential, calling for 136 residential units.

Gary Barnett is one developer bucking the trend. His Extell Development ditched plans for a 10-story office building at 750 Eighth Avenue and has instead received permits to construct a 51-story hotel on the Midtown site.

Read more

[Crain’s] — Holden Walter-Warner