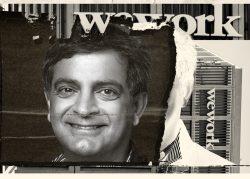

CEO Sandeep Mathrani is putting the “we” in WeWork in a strategic partnership with a flex workplace startup aimed at expanding the company’s global reach.

WeWork is joining forces with office space marketplace Upflex to provide increased access to coworking spaces, according to an SEC filing. Financial terms of the arrangement were not disclosed.

The partnership will give WeWork members access to Upflex’s aggregated portfolio of more than 4,800 third-party spaces across the globe. Upflex’s spaces are provided by more than 700 operators in 80 countries.

WeWork will have the exclusive right to sell Upflex’s inventory to its members. In return, Upflex customers will be able to book WeWork spaces through the provider, the first time WeWork has allowed bookings from a third-party platform.

For WeWork, the partnership allows the country to increase its network of spaces without making major capital investments.

Read more

In addition to the increased access to spaces for customers of both companies, WeWork will also be a participant for Upflex’s Series A funding round.

The partnership is among WeWork’s first expansion moves since going public. The company last month bought Dallas-based coworking space Common Desk in a deal expected to close by March. At the time of the deal, the 10-year-old company reached 4,000 customers at 23 locations in 13 cities in Texas and North Carolina.

The acquisition marked the company’s shift from its 2020 strategy of offloading companies, including office management startup Managed by Q and social network Meetup.

WeWork went public in October via a SPAC merger with BowX Acquisition Corp., two years after its failed IPO. After going public, the company announced its net losses narrowed to $802 million in the third quarter, down from $941 million a year earlier.