A student housing empire already struggling with foreclosures and lawsuits has made a multi-billion-dollar enemy: Fortress Investment Group.

Nelson Partners Student Housing was the subject of a legal notice filed earlier this month by an affiliate of Fortress. The New York Times reported the company controlled by the investment giant is looking to foreclose on a $46 million loan owner Patrick Nelson took out in November 2019 to acquire the Auraria Student Lofts in Denver.

The loan was originally arranged by a division of Cantor Fitzgerald, but was quickly sold to another hedge fund. The Fortress affiliate bought the loan last fall.

The affiliate declared Nelson in default on the loan and went to district court to get a receiver to oversee the property. According to the Times, complaints at the building include broken elevators and poor upkeep.

The Times reported at least two contractors at the Auraria also obtained court judgments, claiming Nelson Partners owes them approximately $100,000 for work done at the building.

In a written statement to the Times, Nelson claimed he was a victim of the investment giant’s dealings.

“The vultures at Fortress bought the loan just weeks before the loan expiration for one reason: to foreclose on a healthy property that has performed well over seven years with the intent to steal millions of dollars in equity they are not entitled to,” Nelson wrote.

Read more

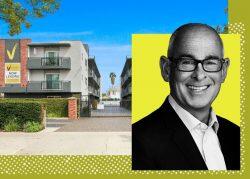

The Times reported in November Nelson’s firm was facing foreclosure on multiple properties, in addition to lawsuits from investors and poor upkeep allegations from tenants. Nelson Partners had raised close to $100 million from about 400 investors, establishing a footprint of two dozen student housing complexes across 10 states.

Investors alleged they weren’t receiving regular payments they were owed. Nelson cited the pandemic as a reason for the firm’s financial problems.

Hedge fund Axonic Capital previously moved to seize Skyloft Austin near the University of Texas in 2020, claiming the firm hadn’t paid dividends and didn’t inform investors of property troubles. A judge last week removed Nelson as the manager of the luxury building, the Times reported.

[NYT] — Holden Walter-Warner