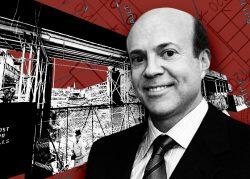

The Zeckendorfs are back with another big development deal.

Brothers William Lie and Arthur are buying Ceruzzi Development’s foreclosed condo project on the Upper East Side for around $250 million, The Real Deal has learned.

Zeckendorf Development is buying the 61-unit Hayworth condo at 1289 Lexington Avenue from U.K.-based lender Children’s Investment Fund, which took control of the property through a foreclosure auction in January.

It’s the second big acquisition in recent weeks for Zeckendorf Development, which inked a deal to develop a $1 billion in Hudson Square.

Representatives for Zeckendorf and the Children’s fund did not immediately respond to requests for comment.

The sale represents a new chapter for the Hayworth, which had been eyeing a sellout of about $375 million.

Read more

Ceruzzi founder Louis Ceruzzi, who died unexpectedly in 2017, began assembling the site about a decade ago. The project moved forward and launched sales in 2019 — during a slowdown in the condo market — and fell behind on its construction loan with Children’s.

Ceruzzi’s president, Arthur Hooper, tried to secure rescue financing for the project and later sought to sell his firm’s equity position. But the price was too high, according to a source familiar with the project, and potential investors balked.

Children’s hired a team at Cushman & Wakefield led by Adam Spies and Adam Doneger to market Ceruzzi’s interest in the project at a UCC foreclosure auction and at the same time market the site to potential buyers. The hedge fund ended up taking over the ownership stake itself and then turned around to sell it to Zeckendorf.

It’s similar to what Children’s did with HFZ Capital Group’s stake at the XI project in West Chelsea, which the lender took over and sold to a partnership of Steve Witkoff and Len Blavatnik’s Access Industries.