Two more firms are jumping into the busy Queens industrial market.

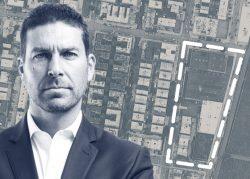

KABR Group and FCA-Orbita Group teamed up to purchase a 3.5-acre site at 184-10 and 184-60 Jamaica Avenue for $73.5 million, the companies announced. The interconnected five- and six-story buildings span 620,000 square feet.

The two buildings are 60 percent occupied, the companies said. The property includes cargo bays, secured access 24 hours a day and more than 120 parking spaces. The new owners said they plan to upgrade loading, add cargo bay capacity and vertical freight capacity, as well as parking.

Eric Benitez, a principal with New York-based FCA-Orbita, credited the “depth and velocity in the Queens industrial market.”

An Avison Young team including James Nelson and Fritz Richter represented the unidentified seller in the transaction.

The property last traded hands in 2017, when public records show Madison Realty Capital teamed up with Artemis Real Estate Partners to buy the properties for $78 million using an acquisition loan from KKR; a Cushman & Wakefield team including Gideon Gil and Zachary Kraft brokered the acquisition loan. The properties were 80 percent occupied at the time.

Read more

KABR, a New Jersey-based private equity real estate firm, was involved in a big deal in 2020, when it sold a 233,000-square-foot building in Ridgefield Park to Asia Investment Management for $60 million. The building is largely leased to Samsung Electronics America.

Data released by Savills in early February show U.S. industrial real estate has grown increasingly crowded and expensive as availability plummeted and asking rents rose 8 percent last year nationally.

The proximity of Queens to New York City and the area’s major transportation hubs has placed it among the metropolitan corners drawing attention for industrial space with ease of access.

In January, East End Capital paid $41.7 million for a renovated industrial property in the Sunnyside neighborhood. Empire Office sold the 140,000-square-foot property.

South Florida- based logistics investor Elion Partners last year paid $58.1 million for a 180,000-square-foot warehouse in Jamaica at 182-20 Liberty Avenue. The sellers were two private families that ran their wholesaling businesses out of the building.