Chaos at the Chatsworth: Co-op says HFZ plundered reserves

Chaos at the Chatsworth: Co-op says HFZ plundered reserves

Trending

Israeli regulator throws support behind Starwood bond default suit

Class-action suit alleges misrepresentation of risks in botched deal

Barry Sternlicht’s Starwood Capital Group is under increased scrutiny in Israel as a lawsuit against the developer counts support from a securities regulator.

The Israel Securities Authority is providing financial support for a class action lawsuit against Starwood, the Wall Street Journal reported. The move is because the lawsuit is in public interest and will likely be certified by a court, but the action doesn’t guarantee support for the plaintiffs beyond paying a portion of legal expenses.

In a statement to the Journal, the firm brushed off the action.

“The [authority] has previously provided funding for many pending lawsuits and it does not affect the merits of any of the cases,” a spokesperson said, noting the lawsuit was without merit. The Journal reported the suit is expected to move forward this year.

Israeli bondholders filed the class-action lawsuit against Starwood in 2019, alleging it misled investigators about the risks of bonds backing struggling shopping centers in the United States. Oporto Securities Distribution claimed the damages totaled 74 million shekels, or $21 million, when the lawsuit was filed.

Read more

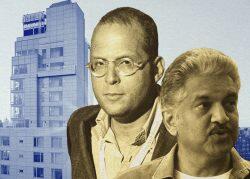

Chaos at the Chatsworth: Co-op says HFZ plundered reserves

Chaos at the Chatsworth: Co-op says HFZ plundered reserves

Rotem Rosen snags refi in Israel for Manhattan hotel, Miami site

Rotem Rosen snags refi in Israel for Manhattan hotel, Miami site

Starwood purchased the portfolio of malls in California, Indiana, Ohio and Washington from Westfield Group in 2013 for $1.6 billion. The firm refinanced the portfolio by raising 910 million shekels (roughly $281 million today) on the Israeli bond market.

The properties struggled as vacancy rates increased and net operating income decreased. When the lawsuit was filed, the bonds had fallen almost 50 percent in price since they were offered about a year earlier. The bonds fell to around 15 cents during the pandemic before trading was suspended in June 2020.

By September 2020, Starwood lost control of seven shopping centers after defaulting earlier in the year on the Israeli bonds. A ratings downgrade on the allowed bondholders to take control of the properties.

The Israel Securities Authority has been cracking down on foreign bonds sales after a slew of high-profile struggles of bond offerings, according to the Journal. Since new regulations were proposed last year, there’s been only one new bond issue by a foreign entity with no affiliation to the country or history in the market.

[WSJ] — Holden Walter-Warner