Cryptocurrency companies may focus on digital assets, but they still care about physical offices.

Crypto and crypto-adjacent firms are an increasing presence in Manhattan office spaces, the Commercial Observer reported. The companies are prime customers for spaces that are efficient, clean, accessible around the clock and come equipped with high-speed, redundant and wireless fiber connection.

Christopher Okada, founder & CEO of family-owned real estate advisory and investment firm Okada & Company, told the Observer the most active areas for leasing by these companies are in the 10016 and 10010 zip codes, encompassing the East 20s and 30s.

Okada noted that many crypto companies appear to be moving away from coworking spaces. While some companies are looking for traditional office space, smaller ones are eschewing the costs of the temporary spaces to stay at home and work remotely instead.

“That market is completely suffering right now,” Okada told the Observer of coworking spaces.

Read more

There have been plenty of leases or subleases signed in New York by cryptocurrency companies in recent months.

Late last year, cryptocurrency data and transaction company Chainalysis agreed to lease more than 77,000 square feet at L&L Holding Company’s 114 Fifth Avenue. The company previously subleased space about half the size, but converted the deal into a direct lease and added two additional floors.

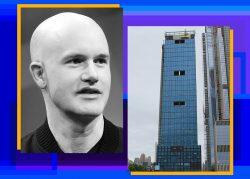

Cryptocurrency exchange platform Coinbase also recently inked a deal to open its first office in New York City, agreeing to sublease 30,000 square feet from Point72 Asset Management’s 339,000-square-foot space at Related Companies’ 55 Hudson Yards. The move came shortly after Coinbase became the first major cryptocurrency company in the U.S. to go public.

[CO] — Holden Walter-Warner