Avi Dishi bought a 10-building multifamily portfolio from Cammeby’s International Group in Washington Heights for $92.2 million, records show.

The sale of 407 residential units across 377,540 square feet includes four commercial units and leasing agreements with nearby Yeshiva University to continue renting apartments to students and faculty.

The largest building in the portfolio, spanning 94,400 square feet with 87 units at 90 Laurel Hill Terrace, sold for $20.5 million. Lazer Sternhell and Peter Vanderpool of Cignature Realty represented the buyer and seller in the transaction.

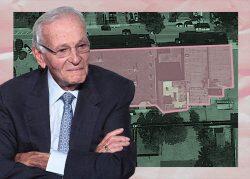

90 Laurel Hill Terrace (Google Maps)

The properties are at 399, 400, 403 and 407 Audubon Avenue; 90 and 110 Laurel Hill Terrace; 497 West 182nd Street; 501 West 184th Street; 556 West 185th Street and 480 West 187th Street in Washington Heights.

501 West 184th Street (Google Maps)

Dishi, a New York real estate investor, has been more active in South Florida of late, buying a shopping center in West Palm Beach and selling a seven-warehouse portfolio in Miami’s Little River neighborhood.

Read more

Rents in the multifamily sector have rebounded strongly in Manhattan amid bidding wars for apartments as Covid eased. Median monthly payments broke records in February, hitting $3,700 and outshining the previous high of $3,450 in April 2020, according to appraisal firm Miller Samuel.

556 West 185th Street (Google Maps)

In another notable portfolio sale, last month A&E bought a 22-building Cunningham Heights apartment complex in Queens Village for $130 million. It was the largest deal for apartments in Queens since the pandemic.

The Covid-era record in Manhattan was set by Black Spruce Management, which bought the American Copper buildings in Murray Hill in December for $850 million.