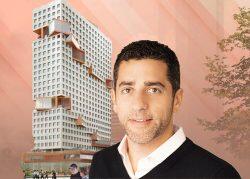

A Williamsburg property is shedding its mob ties and moving forward with a project from a different developer.

Goose Property Management acquired 575 Grand Street from Tapps Supermarkets for $42.5 million, REW Online reported. The company, run by Jacob Katz, was represented by Daniel Lebor and Dan Marks of TerraCRG Partners.

Goose’s moves don’t end there. The developer also scored $86.7 million in acquisition and construction financing from SCALE Lending, according to the Observer. Henry Bodok of Galaxy Capital arranged the financing for the developer.

The developer’s plans at the former Key Foods supermarket site call for a 175,000-square-foot building with 186 housing units. Under the Affordable New York program, 30 percent of the units will be set aside for affordable housing.

Goose has not commented on the acquisition.

The site has had a few false starts in recent years. Building permit applications filed with the Department of Buildings in 2015 called for a six-story rental building with 107 apartments. Development plans included nearly 110,000 square feet of residential space, as well as 26,000 square feet of retail space.

Read more

In 2018, Tapps applied for $4 million worth in tax breaks to build a six-story mixed-use building on the site. Tapps has been owned by Pasquale (Patsy) Conte, a captain in John Gotti’s crime syndicate. As of 2018, it was unclear if Conte still owned part of Tapps – his son’s name was the one on the application for tax breaks.

Goose owns several multifamily buildings in Williamsburg already, including The Garnett on South 4th Street and The Espoir on Hope Street.

SCALE appears to have a similar liking for Williamsburg. Earlier this year, it provided a $137 million loan to the Loketch Group, the Joyland Group and Meral Property Group for the acquisition and construction of 555 Broadway, the former development site of The Collective.

SCALE, an affiliate of Slate Property Group, has executed more than $1.5 billion in loans in the past year, according to the Observer.

[CO] — Holden Walter-Warner