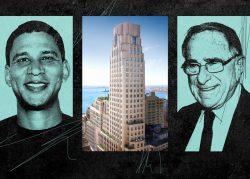

Harry Macklowe’s initial plans for One Wall Street started with a few sheets of handwritten notes. Now, the colossal condo conversion is seeking a massive amount of paper.

Macklowe Properties and Dilmon LLC, the family office of Qatari royal Hamad bin Khalifa Al Thani, are looking for a loan of at least $1.1 billion to refinance the landmarked Art Deco tower, Bloomberg reported. Macklowe is working with Newmark on the solicitation.

The developers are interested in five-year, non-recourse mortgage financing proposals from potential lenders, according to Bloomberg. If the developer scores a $1.1 billion package, it would represent a 48 percent loan-to-cost ratio.

Proceeds from a refinancing would go to paying off construction debt and funding the remaining construction costs, Bloomberg reported.

The condo conversion is nearing the finish line of a nine-year quest to turn the Irving Trust Company Building in downtown Manhattan into luxury residences. Sales are underway at the building and construction is expected to finish by the end of the year.

Read more

In 2020, Macklowe tapped Compass to replace Core Real Estate to sell the 566 units at the Financial District tower. An offering plan approved four years ago projected the building has a sellout of $1.7 billion.

Macklowe purchased the 51-story building in 2014 for $585 million. After various delays, the developer nabbed a $750 million construction loan in 2018 from Deutsche Bank.

A penthouse in the building is listed for $55 million. The property also has a retail component, which counts Whole Foods and Life Time Fitness as tenants.

If condo prices across the country are any indication, Macklowe will want to have One Wall Street up and running quickly. The U.S. condominium market reached an all-time price record last month according to Redfin, while New York’s median condo price rose 11 percent to $599,000.

[Bloomberg] — Holden Walter-Warner