Silverstein raises another $2B for real estate lending fund

Silverstein raises another $2B for real estate lending fund

Trending

Silverstein refis 7 World Trade with $458M in green bonds

Developer preserves major tax exemption on 98% of financing

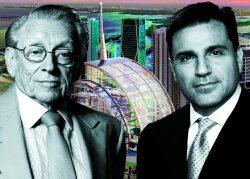

Silverstein Properties has closed on a $457.5 million refinancing at 7 World Trade Center, its LEED Gold office tower in Downtown Manhattan.

The refi comes with serious tax advantages: Tax-exempt bonds make up $449 million of the loan — 98 percent of it. The 52-story building’s construction in the early 2000s was financed through federal, tax-free Liberty Bonds issued in the wake of the 9/11 attacks.

Goldman Sachs led the deal, which was executed in green bonds, a type of financing for projects with environmental benefits. Silverstein has long promoted 7 World Trade’s eco-minded bells and whistles.

“Through its refinancing carried out in green bonds, 7 World Trade Center continues to serve as a blueprint for sustainable development,” said Marty Burger, chief executive officer of Silverstein Properties.

Silverstein refinanced to take advantage of favorable interest rates and strong leasing performance, said Dara McQuillan, a spokesperson for the developer.

Read more

Silverstein raises another $2B for real estate lending fund

Silverstein raises another $2B for real estate lending fund

Miami Worldcenter developer nabs $340M financing for mixed-use tower, marking third largest construction loan ever in Florida

Miami Worldcenter developer nabs $340M financing for mixed-use tower, marking third largest construction loan ever in Florida

The developer also announced four lease signings at the building, including two new deals totaling 45,400 square feet. Capstone, an alternative investor, secured 40,000 square feet. Tenants at the 1.7-million-square-foot tower include Moody’s, Moët Hennessy and Zola.

The building, at 250 Greenwich Street, is now 97 percent leased. Designed by David Childs of Skidmore, Owings & Merrill, it stands 741 feet tall and opened in 2006.