Equity Residential ditches Trump name at UWS rentals following tenant petition

Equity Residential ditches Trump name at UWS rentals following tenant petition

Trending

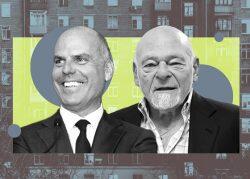

Sam Zell sells former Trump Place apartments on UWS for $266M

A&E Real Estate purchased the 354-unit rental building, which dropped the Trump name in 2016

First, Sam Zell ditched the Trump Place name at a trio of luxury rental buildings on the Upper West Side. Now, Zell’s ditching one of the properties altogether.

Zell’s Equity Residential is selling the 354-unit building at 140 Riverside Boulevard to Douglas Eisenberg’s A&E Real Estate for $266 million, Bloomberg reported.

Built in 2003, the property overlooks the Hudson River and includes amenities such as a gym, a playroom and lounges. Equity was represented in the sale by CBRE, according to Bloomberg.

The building’s biggest claim to fame, however, might be its separation from Donald Trump’s branding. In 2016, the three buildings formerly known as Trump Place —140, 160 and 180 Riverside Boulevard — dropped the name to “assume a neutral building identity,” Equity said at the time. The name change, shortly after Trump’s election, came after residents of at least one building began circulating a petition.

The buildings at 160 and 180 Riverside Boulevard were apparently not included in the sale to A&E.

The deal comes weeks after A&E completed Queens’ largest multifamily deal since the start of the pandemic, paying $130 million for the 22-building Cunningham Heights apartment complex in Queens Village. The complex has more than 1,000 apartments and was 99 percent occupied at the time of the sale.

Zell’s sale of the Upper West Side multifamily building does not necessarily signify waning interest in the rental market. Last year, Equity teamed up with homebuilder Toll Brothers to develop apartments across the country. The firms said they plan to spend at least $1.9 billion on the joint venture.

Rents in Manhattan shattered records in February, hitting $3,700 and easily outpacing the previous high of $3,450 in April 2020, according to a report by appraisal firm Miller Samuel. Renters had a one-in-five chance of facing a bidding war and rentals sat on the market for just 24 days on average.

Read more

Equity Residential ditches Trump name at UWS rentals following tenant petition

Equity Residential ditches Trump name at UWS rentals following tenant petition

A&E makes biggest Queens apartment deal of pandemic

A&E makes biggest Queens apartment deal of pandemic

Equity, Toll Brothers partner on apartments for $1.9B

Equity, Toll Brothers partner on apartments for $1.9B

[Bloomberg] — Holden Walter-Warner