Facing mounting foreclosure woes, retail developer and broker Jack Terzi is launching an eleventh-hour lawsuit to save a piece of his Manhattan property empire.

Terzi is days away from losing the ground-floor retail space at 349 West Broadway in Soho. Since the pandemic forced his tenant, a coffee shop, to shutter operations, Terzi has allegedly racked up over $4 million payments owed to lender Bethpage Federal Credit Union.

As a result, Bethpage declared Terzi’s loan in default and plans to auction the Brooklyn-born retailer’s shares in the building co-op on April 12. But before Terzi’s shares hit the auction block, he’s throwing the kitchen sink in a bid to persuade a judge to halt the sale.

In his complaint, Terzi blames his missed payments not just on Covid, but also incessant, unexpected construction on the building that he says has scared off potential tenants. Terzi adds that Bethpage’s notice of default came from its lawyer, not Bethpage itself, a discrepancy he argues invalidates the notice. As a cherry on top, he says that even if the default were valid, the building’s scaffolded state would hurt its value at auction, so the judge should delay a sale until construction wraps.

The auction, scheduled for April 12, would offer Terzi’s shares in the building co-op, which grant him the ground-floor commercial space. But the building is in the midst of a facade inspection and repair, which obscures its front with a sidewalk shed and netting. Terzi is also in the process of dismantling a structure in the building’s rear yard at the behest of the co-op board, a project he says has cost him $100,000.

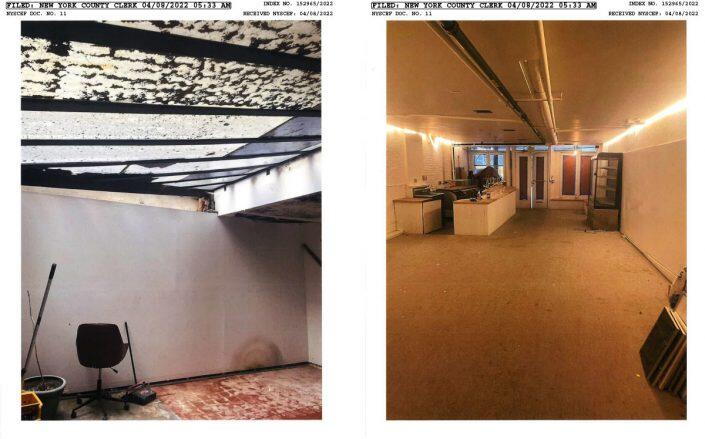

Photos of the construction at 349 West Broadway (New York County Clerk)

Ever since the coffee shop ceased operations in March 2020, Terzi has missed debt payments. He can’t find a new tenant to replace the old one, which shuttered permanently in October. Meanwhile, his alleged $4 million debt to Bethpage is more than he borrowed in the first place.

But images from Google Street View suggest the property struggled with occupancy long before its present Covid- and construction-related woes. One view from Sept. 2016 shows the windows papered over, with graffiti lining the cream-colored storefront. The following year, the graffiti had spread and the window coverings had switched from paper to cardboard.

Brooklyn Diamond Coffee leased the space in late 2017 and held onto it until the store closed for good seven months into the pandemic.

Terzi’s woes came to a head last month, when he received a letter from Jarret Behar, an attorney representing Bethpage, declaring the loan in default and notifying him that the lender planned to auction his shares. Terzi had pledged his stake in the co-op as collateral in 2018, when he secured a $3.5 million refinancing on the property. Behar’s letter also enumerated Terzi’s alleged debts on the property, including more than $580,000 in interest, late fees and legal costs.

Neither Terzi nor Behar responded to requests for comment.

Read more

Bethpage hasn’t yet responded to the allegations in court, but Terzi has his hands full with legal battles. Wells Fargo has moved to take over his “jewel box” retail space at 63 Spring Street on behalf of commercial bond holders who say he hasn’t paid rent since April 2020. He’s also battling China Sonangol, which claims he defaulted on his lease at its 23 Wall Street in June.