As the office market teeters on the brink of a calamity, landlords are preparing for a big rise in vacancies this year.

JLL data shows about 243 million square feet of office leases are set to expire across the country in 2022, the Wall Street Journal reported. The figure is a 40 percent increase from 2018 and the highest since JLL began tracking it in 2015, representing approximately 11 percent of the country’s leased office space.

The volume of lease expirations is projected to exceed 200 million square feet in each of the following three years as well, which could only be the beginning, considering Green Street reportedly estimates a 15 percent decline in office demand.

The surge is preceded by tenants negotiating shorter lease extensions than usual while landlords rode out the storm. Brokers told the Journal as more companies confront the reality of a hybrid work environment, they’re looking for smaller spaces.

That’s bad news for office landlords, who have been able to avoid the worst of the pandemic as they continued to collect rent, regardless of whether or not tenants’ employees were in the office.

“I don’t think the landlords have felt the pain yet,” Jeffrey Peck, vice chairman of Savills, told the Journal. “Now they’re going to start feeling the pain.”

Read more

Landlords won’t be the only ones hurting. Banks and other lenders may also be stuck with more troubled loans if office properties begin underperforming as a result of vacancies.

Barclays reported in February that 21.2 percent of office loans made after the recession package into CMBS deals were either with special servicers or on watch lists, the highest level in more than a decade. Trepp reports about $1.1 trillion of loans backed by office buildings are already outstanding, while another $320 billion of loans will mature in the next two years.

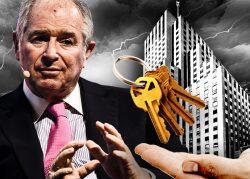

Last month, Blackstone handed the keys over to its Midtown office building at 1740 Broadway. A $308 million loan was transferred to special servicing, which typically results in the servicer acquiring the title via deed-in-lieu of foreclosure. Blackstone is seeking loan resolution options, saying the “asset faces a unique set of challenges.”

The national vacancy rate is already 12.2 percent, the highest of the pandemic, according to CoStar data reported by the Journal. It’s up from 9.6 percent at the end of 2019.

[WSJ] — Holden Walter-Warner