Architects and designers hit a wall — literally — when it’s time to put finishing touches on a project. They must search and sample thousands of tile, paint and carpet options from hundreds of manufacturers. It’s fragmented, expensive and time-consuming.

Investors just poured $175 million into a startup seeking to streamline that process.

Material Bank claims to have created the first comprehensive, centralized marketplace for such materials — an Amazon of sorts for designers and architects.

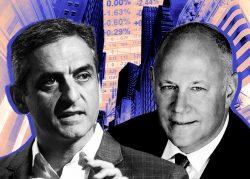

Its Series D round, led by Brookfield Growth, the venture capital arm of private equity giant Brookfield Asset Management, values the Boca Raton-based startup at an estimated $1.9 billion, according to Bloomberg, which first reported the funding round Friday.

RXR, Fifth Wall and Softbank’s Vision Fund 2 also participated in the round.

Read more

The round comes roughly a year after Material Bank’s $100 million Series C and brings its total equity funding to more than $325 million, it said. The company was valued at $975 million in the previous funding round, according to data from PitchBook.

Launched in 2019, Material Bank uses an automated logistics system, with a 400,000-square-foot warehouse near Memphis at its center, to deliver samples in a matter of hours. Through a partnership with Fedex, if customers place an order by midnight, it arrives at their desk the following morning.

Its hundreds of brand partners shoulder the costs so the service is free to end customers, which include real estate firms, construction companies, and restaurant and hotel chains. As of early May, Material Bank had close to 100,000 users, including thousands of corporate clients, according to CEO Adam Sandow.

“This has really become the primary way a lot of these manufacturers connect with buyers,” he said in an interview.

Material Bank has 325 employees. It plans to launch in Japan at the end of the year, and in Europe early next year.

The company is also an active acquirer of other tech startups. In March, the company bought Amber Engine, a product information management platform.

“We’re not just rolling up companies,” he said. “We are very selective, looking for highly strategic acquisitions.”