In for a Dime: Williamsburg apartments asking big price tag

In for a Dime: Williamsburg apartments asking big price tag

Trending

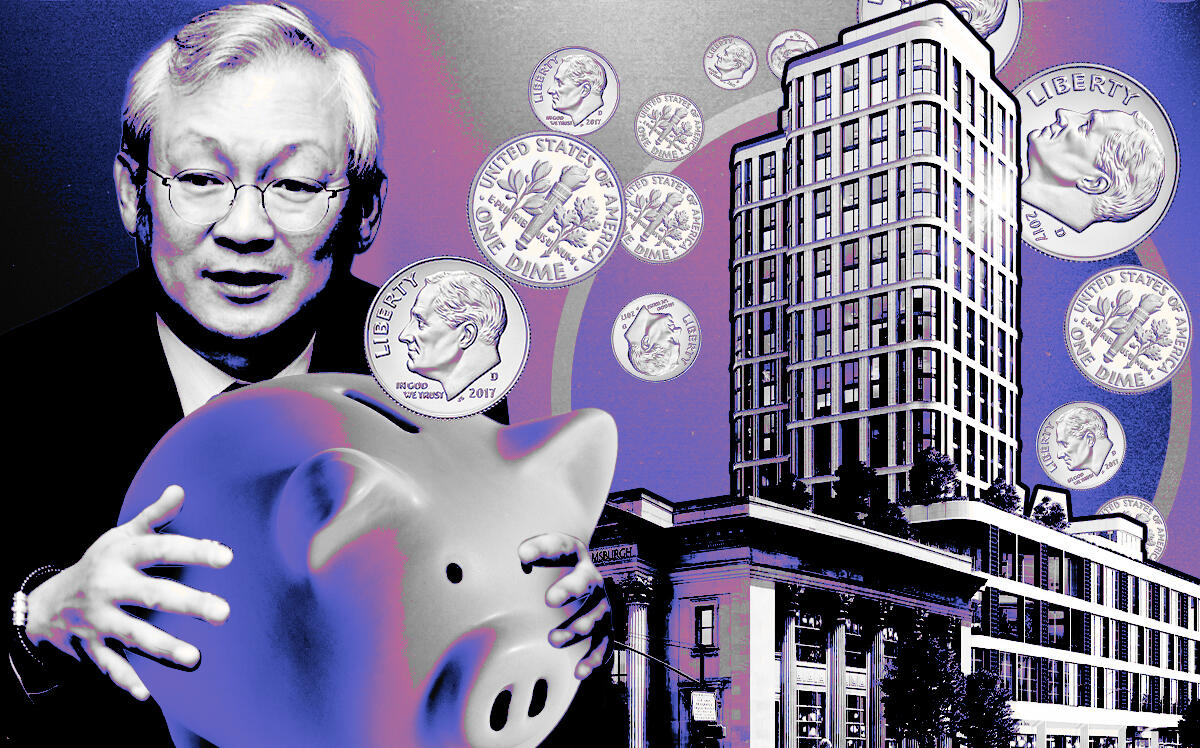

Pile of dimes: Korean investor poised to purchase Williamsburg rental

NH Investment & Securities under contract to buy the Dime for $158M

A multifamily building in Williamsburg is set to trade for a lot of dimes.

Korean investment firm NH Investment & Securities signed a contract to purchase the Dime for $157.5 million, people familiar with the deal told the Commercial Observer. The sale would only include the multifamily portion of the 340,000-square-foot building, not the retail component.

Tavros Capital Partners and Charney Companies put the apartment building on the market at the beginning of the year, sources previously told The Real Deal. The developers were looking to get about $165 million for the building’s rental portion.

A Cushman & Wakefield team including Adam Spies and Adam Doneger negotiated the sale, which is expected to close in the next two months.

The building, which sits near the base of the Williamsburg Bridge, was completed in 2020. Its name comes from the landmarked Dime Savings Bank of Williamsburg, which was converted into the retail space of the 23-story development.

The Dime includes 177 rental apartments and 23,000 square feet of amenity space, which includes a fitness center, a basketball court and a penthouse lounge. The property has a 35-year tax abatement under the Affordable New York program and 30 percent of the units are income-restricted for renters earning no more than 130 percent of the area median income.

Read more

In for a Dime: Williamsburg apartments asking big price tag

In for a Dime: Williamsburg apartments asking big price tag

Korean firm makes US debut with $266M acquisition from Related

Korean firm makes US debut with $266M acquisition from Related

Charney, Tavros pick up stalled LIC development site

Charney, Tavros pick up stalled LIC development site

Korean investment firms are making their presence better known in the New York City multifamily market in recent weeks.

Eugene Asset Management made its American debut a few weeks ago when it reportedly bought the 285-unit Lyric rental on the Upper West Side from Related Companies for $266 million. Spies was also part of the team that negotiated that sale.

As one development exits, another enters the sphere for Tavros and Charney. The buyers signed a contract to buy the development site of a planned hotel in Long Island City, which was being offered for about $60 million. Toyoko Inn spent eight years assembling the site, but never got its project off the ground.

[CO] — Holden Walter-Warner