Times Square Sheraton loss $33M worse than reported

Times Square Sheraton loss $33M worse than reported

Trending

Midtown’s Hudson Hotel slated for mixed-use redevelopment

Shuttered establishment to be converted to 438-unit residential project

UPDATED May 11, 2022, 10:45 a.m.: An unknown buyer has picked up the Hudson Hotel, setting the shuttered Midtown property on a new course.

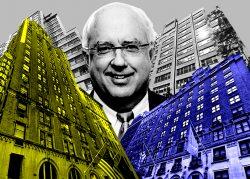

The 866-key hotel at 356 West 58th Street has been closed since the onset of the pandemic, but its new owner has big plans for the 385,000-square-foot property, according to the Commercial Observer, securing a $207 million loan from Parkview Financial and Montgomery Street Partners for its purchase and redevelopment. While the 24-story building will no longer be a hotel, it will be a 438-unit residential development with office and commercial space.

The Commercial Observer initially reported that Cain International had acquired the hotel, but representatives for Cain denied that it was a party to the acquisition loan. They said the property had been sold, but declined to identify the buyer. Cain was appointed by the then-owner Eldridge Industries in 2020 to lead a strategic repositioning of the 90-year-old hotel.

A Meridian Capital Group led by Morris Betesh and Alex Bailkin negotiated this week’s transaction, according to the Observer.

The property has been through a number of iterations in the last century. It was built in 1929 as the American Women’s Association clubhouse, serving as a residence for young women. Twelve years later, it was converted into the Henry Hudson Hotel. And in 1997, Morgans Hotel Group purchased the property and turned it into Hudson New York Hotel.

Morgans Hotel Group was reported in 2014 to be considering selling the property to boost the company’s share price. Sources told the New York Post at the time the group expected the hotel could be sold for about $440 million.

Read more

Times Square Sheraton loss $33M worse than reported

Times Square Sheraton loss $33M worse than reported

Airbnb’s losses narrow as bookings hit all-time high

Airbnb’s losses narrow as bookings hit all-time high

Midtown hotel portfolio sale suggests big value drop

Midtown hotel portfolio sale suggests big value drop

In 2017, Sam Nazarian’s SBE Entertainment landed a $425 million refinancing of both the Hudson Hotel and Delano South Beach properties, courtesy of Column Financial. The deal came months after SBE and partners Yucaipa and Cain Hoy closed on an $800 million acquisition of Morgans Hotel Group, a deal that included management of 13 hotels.

Last year, Cain International and Beny Alagem received $500 million in refinancing from Aareal Capital and Goldman Sachs for two hotels in Beverly Hills. Aareal Capital provided the $340 million senior mortgage loans on the hotel, while a Goldman Sachs real estate fund provided a $160 million mezzanine loan.

[CO] — Holden Walter-Warner

This article has been updated with new information regarding the hotel’s ownership.