Their decade-long court battle with Douglas Durst over a Long Island City development site is over. But lawyers representing the investors who bought out Durst last week for $96.9 million say it could have been avoided.

“It was a tremendous ordeal and probably a waste of an immense amount of legal fees going through what we went through with Durst,” said Jay Neveloff, a partner at Kramer, Levin, Naftalis & Frankel.

The Durst Organization held the mortgage on the waterfront site, 44-02 Vernon Boulevard in Queens, and filed to foreclose in 2009 after acquiring the non-performing debt. Durst spent millions of dollars on property taxes and environmental violations for more than a decade to prevent the city from seizing the neglected property.

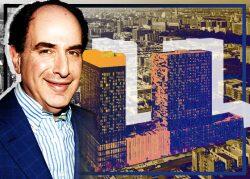

The site’s would-be developers, led in part by Bruce Teitelbaum, have wanted to pay back the loan for years, but disagreed with Durst on how much money was owed and what interest should be charged while the loan was in default.

The case seemed simple enough, but it dragged on for years. Durst is known as a tough negotiator adept at using the legal system to get his way, as he did in stalling Barry Diller’s island project on the Hudson River until the state sped up plans for Hudson River Park.

Under the state’s equity of redemption right, Durst couldn’t take control of the Long Island City site as long as the owners paid the money owed. Nor could they proceed while he held the site’s debt. An impasse resulted.

A court-appointed referee in the foreclosure proceedings put the amount owed at $69.3 million in 2019. Durst, however, deemed that too low and filed an objection. In May 2020, a state judge agreed with the amount set by the referee.

The $96.9 million buyout paid by Teitelbaum’s group to Durst was the sum of two mortgages that the latter held on the property and 9 percent statutory interest, Kramer Levin’s Natan Hamerman told The Real Deal.

Michael Dell’s MSD Capital was determined to be the best suited lender and ultimately provided the financing for the deal, Neveloff said. Tietelbaum and his partners closed on the loan last Tuesday, allowing them to end the dispute with Durst.

“MSD was terrific,” Neveloff said. “MSD was aware of the situation. They were aware that Durst was going to do almost anything it could to make it more painful and difficult. And they stuck it out. They liked the asset, they felt comfortable with it, they liked the relationship and MSD gets a lot of credit.”

The Durst Organization is making no apologies, but also casting no stones.

Read more

“It’s a lot of money and we are pleased with the outcome and hope they are as well,” Durst spokesperson Jordan Barowitz told TRD when asked why a resolution took so long.

Durst’s exit clears the way for the “Lake Vernon” redevelopment — the site is known for its large puddles — to move ahead, but hurdles remain.

Plans call for a mixed-use development on a 28-acre site near the Anable Basin in Queens that includes properties owned by TF Cornerstone, Plaxall and Simon Baron Development.

The developers could build a 1.2 million square-foot residential building with a small commercial space as-of-right, but will seek a rezoning to construct something larger. In that scenario, the residential portion would have to include affordable housing.

Any rezoning would hinge on the approval of City Council member Julie Won, a Democrat who represents the area.

The property is worth at least $200 million, but the project’s cost remains unknown. A development partner for the project has yet to be chosen.

“The Long Island City waterfront is a jewel that can stand some polishing,” Teitelbaum said. “My hope is to be part of its transformation where we can create plentiful housing and other amenities to satisfy the needs of local residents. It’s an exciting opportunity which I am confident will lead to great things for LIC.”

After Amazon abandoned an effort in February 2019 to build part of a second headquarters on the Anable Basin development site, the owners made plans to develop as many as 15 buildings there.

They presented a plan to the local community board in May 2020 that broadly outlined 10 million to 12 million square feet of development over the next 10 to 15 years. Half of that total is expected to be commercial, and the rest split between residential and other uses.