A $100 million settlement was not enough to settle all of the differences at a Fifth Avenue retail property.

Lender Wells Fargo is holding the property owner at 693 Fifth Avenue, previously identified as French holding company Financière Marc de Lacharrière, in default. The bank is demanding full payment of a $227 million loan balance, Crain’s reported, alleging a number of issues with the landlord’s settlement with Valentino.

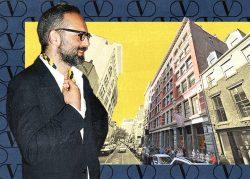

The settlement with the luxury fashion house’s outpost came about a couple of months ago. Valentino sued in June 2020 to terminate its 15-year lease, complaining of Covid-19 restrictions and the growing threat of e-commerce.

The landlord didn’t take too kindly to the lawsuit. In January 2021, a judge ruled Valentino still needed to pay its rent, leading to a suit from the landlord. It accused Valentino of ditching its lease eight years and about $200 million early after it left in December 2020.

The dispute ended with a $100 million lawsuit, but Wells Fargo has alleged several issues with the landlord. The bank argued the settlement should’ve been put in the building’s reserve account. It also said Valentino’s lease was terminated and the settlement amount was agreed to without its permission.

Read more

The property owner has countered in court documents, claiming several attempts to get in touch with Wells Fargo about the settlement received no response. The landlord also said it needed to repay its parent company, Namlac, $50 million for covering mortgage payments during the Valentino dispute and keeping the loan current.

The loan has since been sent to special servicing.

Wells Fargo said in its complaint the $50 million repayment to Namlac was “fraudulent.” The landlord said it never “intended to defraud them in any manner.” It also said a requirement to repay the full loan balance immediately “would subject the property to foreclosure.”

Valentino may have been the impetus of the latest dispute, but it seems to be fine staying out of it. While its own lawsuit was being waged, the brand signed a two-year deal to open its first Soho store, taking nearly 8,800 square feet in a duplex at 135 Spring Street.

[Crain’s] — Holden Walter-Warner