A long-delayed office project in the East Village can finally proceed after the developer landed a $70 million loan.

Parkview Financial announced this week it provided the loan for the refinancing and construction of a nine-story, 61,000-square-foot building at 1 St. Marks Place. The developer on the project is Real Estate Equities Corp.

The loan refinances an existing land loan, as well as previous construction financing. Development of the project is underway and slated for completion in June 2024.

REEC’s plans for the development include 53,000 square feet of office space and more than 7,700 square feet of retail space. Parkview CEO Paul Rahimian said in a statement the boutique office building could be in “high demand from the growing number of tech companies in the area.”

The developer gained control of the property via a 99-year lease it signed in 2017 for more than $150 million. Two years later, South Korean financial services firm Hana Financial Group provided a $79.1 million loan. It then sold the $48 million first mortgage to Madison Realty Capital and held onto a $31.1 million mezzanine loan.

Read more

Things started to go off the tracks with the onset of the pandemic. In August, Madison Realty Capital took the first steps towards foreclosing on REEC’s leasehold interest, filing a complaint that alleged REEC defaulted on the mortgage.

A spokesperson for REEC told The Real Deal at the time the developer was working on a recapitalization plan and was optimistic about resolving the issue quickly.

The development is across Third Avenue from 51 Astor Place. As of 2019, REEC was shooting for top-dollar rents at the boutique office building, planning to ask for around $150 per square foot. It’s not clear what the developer will be seeking when the project finally comes to fruition.

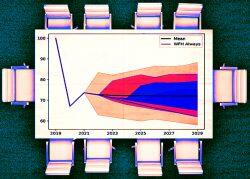

The office market has been decimated in the wake of the pandemic. A recent analysis predicted that by 2029, the city’s office stock will drop in value by 28 percent, or roughly $49 billion, due to lease revenue falling and remote work rising further.