BRP Companies has broken ground on yet another Jamaica apartment complex after securing funding from Tammy Jones’ Basis Investment Group.

The development firm co-founded by Meredith Marshall and Geoff Flournoy landed $378 million in construction financing led by Basis for a 614-unit residential building at 90-02 168th Street in the Queens neighborhood.

The building, dubbed 90Ninety, will provide workforce housing to the local community, Marshall said in a statement. About one-third of the building’s units — studio, one- and two-bedroom apartments — will be reserved as affordable to households earning 80 to 130 percent of the area median income.

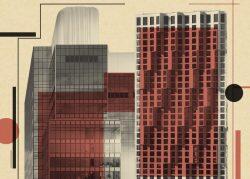

BRP filed plans for the 12-story, 716,000-square-foot structure in 2020, with Perkins Eastman listed as the architect of record. It is scheduled for completion in 2025 and will include 25,000 square feet of retail and 15,000 square feet for amenities. The developer bought the land, also known as 166-20 90th Avenue, from the Greater Jamaica Development Corporation in 2015.

“As someone who grew up in affordable and workforce housing in South Jamaica, Queens, I couldn’t be more excited and proud to be involved,” said Jones, Basis’ co-founder and CEO, in a statement.

BRP declined to comment further on the financing; Jones was not immediately available for comment.

Read more

The building will rise near the Jamaica Long Island Rail Road station, which provides AirTrain service to JFK Airport, as well as a shopping corridor on Jamaica Avenue where Jeff Sutton’s Wharton Properties owns five retail buildings.

Basis Investment bought into the rental project in 2019 with a $32.4 million loan that refinanced $15 million in acquisition debt provided by Turnbridge Real Estate Credit Strategies.

BRP Companies has two other residential projects in the neighborhood: Archer Towers, a 24-story project with 604 units that broke ground last year at 163-05 Archer Avenue, and a 539-unit project completed last year at 147-40 and 148-10 Archer Avenue called the Crossing at Jamaica Station.

In a recent interview with The Real Deal, BRP’s Marshall noted that the development sites are near the Jamaica Center–Parsons/Archer subway station, a location featured in his favorite film, “Coming to America.”

The New York City Council voted in 2007 to rezone 368 blocks along Jamaica Avenue to spur investment in the area.