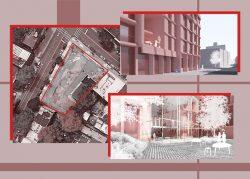

Brooklyn-based development firm Tankhouse has agreed to buy the development site at 452 Union Street in Gowanus from Pilot Real Estate Group.

As part of the deal, Tankhouse tendered a $4 million down payment and agreed to pay another $3 million before closing. The total sale price has not been disclosed.

Tankhouse co-founder Sam Alison-Mayne says the site has already qualified for the 421a tax break, a critical multifamily development incentive that expired in June. The firm plans a mixed-use development with a “significant” non-residential component on its new lot, which stretches a full city block and abuts the Gowanus Canal.

Alison-Mayne said the project would be larger than his firm’s previous foray into Gowanus, a five-story, 18-unit condo project at 450 Warren Street. That project gained attention for its focus on outdoor space and greenery, which helped it stand out in the early days of the pandemic when buyers were craving outdoor space. The company also plans projects in Downtown Brooklyn, Clinton Hill and Boerum Hill, according to its website.

Pilot received approval in April for excavation work for an eight-story, 81,000-square-foot building with 24 apartments. That plan included 35,000 square feet of commercial space. No permits to demolish the existing one-story retail building on the parcel have been filed with the Department of Buildings.

Most of Gowanus was rezoned last year to allow for more residential development. More than 8,000 apartments are expected to be built as a result. Each new multifamily building will be required to include affordable units.

Read more

Pilot, a Greenwich, Connecticut-based investor, was among a swarm of real estate firms that filed plans and worked to get footings in the ground before 421a expired. With no replacement for the tax break in sight, more trades for 421a-ready development sites could be on the horizon.

In 2014, Pilot acquired the site for $12.3 million from Meadow Street Partners.