RXR and the Blackstone Group are in contract to sell 1330 Sixth Avenue weeks after putting the 40-story office property on the market.

The joint venture is selling the building to Empire Capital Holdings for $325 million, a person with knowledge of the deal told the Commercial Observer. When marketing efforts were first reported in June, the joint venture was looking for $350 million.

Empire Capital plans on putting new debt on the property to fund the purchase. The building has $285 million in debt from DekaBank via a 2018 refinancing, which paid off a $200 million loan from New York Community Bank.

When the joint venture started marketing, it was believed the $285 million loan would be paid upon a sale, but it’s not clear if that’s the case.

The sale is expected to close by the end of the year.

RXR led a group of investors in the purchase of the building in 2010 for about $400 million. The seller at the time was Canadian lender Otera Capital, which took the 520,000-square-foot property from Harry Macklowe after he was forced in 2009 to put it up for auction; Macklowe purchased the property in 2006 for $498 million.

Read more

Blackstone became a part owner of the property formerly known as the Financial Times Building in 2015, buying a stake as part of a 50 percent stake deal involving six RXR properties.

Tenants include Silvercrest Asset Management, Knoll and the Robert Wood Johnson Foundation. Silvercrest has the honor of having its initials adorn the top floor of the tower.

An Eastdil Secured team including Steven Binswanger, Gary Phillips and Will Silverman brokered the deal for the joint venture.

This is Empire Capital’s second big office purchase in recent months. Empire bought the office building at 345 Seventh Avenue with Igal Namdar of Namdar Realty Group for $107 million. The seller of the 220,000-square-foot building was Clemons Management.

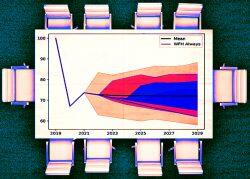

The continued decline of the building at 1330 Sixth Avenue could be a harbinger of what’s to come in New York’s office market. An analysis from NYU’s Arpit Gupta and Columbia University’s Vrinda Mittal and Stijn Van Nieuwerburgh recently determined that by 2029, the city’s office stock will drop in value by 28 percent, or $49 billion.

— Holden Walter-Warner