Blackstone explains how it’s beating inflation, rate hikes

Blackstone explains how it’s beating inflation, rate hikes

Trending

Blackstone posts $29M loss, touts relative strength of real estate holdings

Investment firm remains bullish on multifamily, logistics

Blackstone slipped into the red in the second quarter as macroeconomic stressors including inflation and rising interest rates took a toll on its portfolio

The investment firm reported a net loss of $29.4 million, or 4 cents a share, for the quarter, down from its $1.3 billion (or $1.82 per share) profit in the same period last year.

Despite the decline, executives on an earnings call Thursday stressed the performance of Blackstone’s real estate holdings compared to the broader public markets and laid out perceived opportunities for further investment and increased returns.

Compared to its private-equity portfolio, which depreciated by 6.7 percent in the quarter, Blackstone’s Core+ real estate business appreciated 2.3 percent year over year, making up for the 1 percent loss posted by the firm’s opportunistic real estate ventures.

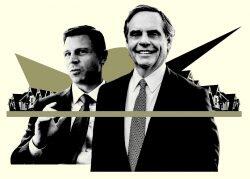

That’s a far cry from the 7.2 and 12 percent gains those respective arms posted two quarters ago, but CEO Stephen Schwarzman noted that the MSCI U.S. REIT index — which tracks the performance of publicly traded U.S. real estate investment trusts — posted a nearly 17 percent decline in the same period.

“Our flagship strategies dramatically outperformed the relevant market indices, most notably real estate,” Schwarzman said.

Blackstone attributed that performance to heavy investment in rental housing and logistics, two sectors that have shown resilience to economic headwinds as rents outpace inflation and vacancy rates remain at record lows. Those sectors comprise 80 percent of the firm’s private real estate investment trust BREIT, a portion of its Core+ business.

The firm estimated rents for its logistics properties in the U.S. and Canada grew 40 percent year over year in the second quarter, while rents on its U.S. multifamily properties were up 19 percent annually as of May.

“BREIT perfectly exemplifies the strength of our concentrated strategy in these two areas,” said Jonathan Gray, the firm’s chief operating officer.

Gray acknowledged that rent growth will eventually slow. Some reports are already indicating a nationwide cooldown. But as long as higher construction and financing costs hinder the delivery of new homes to the market and rising mortgage rates deter prospective buyers, the executive said, demand for rental housing will remain strong.

“People still have to live somewhere,” Gray quipped.

On the logistics side, he added, supply-chain issues and the enduring strength of e-commerce continue to create “real demand” for space that can be used to stockpile inventory.

Despite the net loss, the quarter was a profitable one for Blackstone investors. Distributable earnings nearly doubled from the year before to $1.49 per share, driven largely by two major real estate deals.

Blackstone sold the Cosmopolitan hotel and casino in Las Vegas in mid-May for $4 billion more than it spent to buy it in 2014, its most profitable single asset sale ever. It also recapitalized its European logistics business Mileway in a $24 billion deal that the firm called the “largest-ever private real estate transaction globally.”

And though its opportunistic real estate shrunk this quarter, Blackstone touted that fresh fundraising capabilities would likely boost holdings down the road. The firm launched a new global real estate flagship fund in March with a goal of raising $30.3 billion. Gray said the fund had so far closed on $24.4 billion and allocated the remaining $5.9 billion.

Combining that investment runway with existing BREIT funds in Europe and Asia, Blackstone said it would have $50 billion of opportunistic real estate capital to deploy globally, only 12 percent of which is invested today.

Responding to concerns that the firm’s sunny outlook for real estate doesn’t square with its balance sheet, Schwarzman closed the call by, again, asking analysts to keep in mind the earnings it has brought to shareholders, even in a bear market.

The CEO offered an anecdote: A BREIT investor approached him recently to praise the firm, saying, “I love you guys. All of my friends are losing a fortune in the markets and I’m making money.”

“We’re providing enormous value to people who are investing, who remember it,” Schwarzman said. “And if you don’t think that’s a reason for optimism, then I find that odd.”

Read more

Blackstone explains how it’s beating inflation, rate hikes

Blackstone explains how it’s beating inflation, rate hikes

Blackstone reports “the most remarkable results in our history”

Blackstone reports “the most remarkable results in our history”

Blackstone buying multifamily REIT in $5.8B deal

Blackstone buying multifamily REIT in $5.8B deal