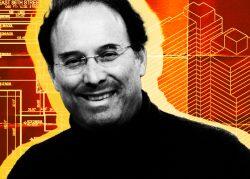

Gary Barnett’s Extell Development accused the developer behind one of Manhattan’s priciest condominiums of plotting to swindle Extell out of a $21 million lease and steal away a retail tenant.

Attorneys representing the development firm filed a lawsuit Monday in Manhattan accusing Landsea Homes of breaching its contract to sell Extell a 11,200-square-foot retail unit at 540 Sixth Avenue.

Extell also accused Landsea of attempting to strong-arm the closing of the unit while Extell was still disputing the terms of the deal. The complaint was first reported by Commercial Observer.

The developer is asking the New York Supreme Court to force Landsea to sell the retail condo unit. The firm is also seeking at least $5.6 million plus interest in damages it alleges came about from Landsea’s actions to terminate the deal and interfere with its tenant agreement.

Extell accused Landsea of failing to complete the retail condo unit before the transaction was set to close at the end of June, alleging that the seller had sought multiple amendments to the contract in order to push back the closing date. After both parties failed to reach terms on a sixth amendment to the purchase and sale agreement, Landsea “decided to take matters into its own hands,” according to the lawsuit.

Attorneys for Extell alleged Landsea “concocted a scheme” to keep the retail unit and Extell’s deposit for itself, all while attempting to execute a lease of its own with the tenant, described in the complaint as a national bank, Extell found for the space.

As part of the alleged scheme, Landsea sent Extell a “sham” notice stating that it had satisfied all closing conditions and that the deal would be finalized in early July. Landsea also allegedly asked Extell to provide the contact information for the tenant it had reached an agreement with for the space.

Extell rejected Landsea’s “bad faith” closing notice, claiming the seller had failed to satisfy its concerns and had made no effort to address any legal or factual issues. Extell’s lawyers described Landsea’s “wholly improper” closing notice as invalid because the seller had failed to meet its obligations.

Read more

After more back-and-forth, Landsea backed out of the deal and kept the down payment after the buyer accused the seller of defaulting on the transaction, Extell said in the suit. Extell’s lawyers alleged Landsea claimed it had the right to terminate the deposit after Extell refused to comply with the closing date.

The award amount in the case — which would be determined at trial — would account for out-of-pocket expenses, lost leasing revenue and increased financing costs, according to the lawsuit.

Landsea has at least 20 days to respond to the complaint. A default judgment will be rendered against the defendant if there’s no response within the allotted time period, according to the complaint.

Landsea declined to a request for comment. Representatives for Extell did not immediately respond to a request for comment.

The condominium, more commonly known as Förena, was developed by Landsea and DNA Development after buying the site for $52.8 million from Extell in 2018, City Realty reported. Landsea and DNA knocked down the pair of four-story properties to make way for its project.

The 12-story, 50-unit building at the intersection of Chelsea, Greenwich Village and Flatiron was one of the priciest condo filings in Manhattan last year at $127 million.