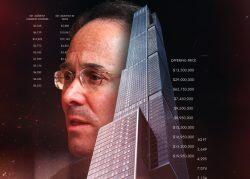

Another Central Park Tower pad has sold for far less than its original ask, and developer Gary Barnett recognizes his supertall isn’t going to achieve the lofty sellout he once envisioned.

The latest sponsor unit to sell at Billionaires’ Row’s tallest skyscraper went for $43 million, the Wall Street Journal reported , 33 percent less than the $63.8 million Barnett’s Extell Development originally sought when it placed it on the market in 2019.

The anonymous buyer lives in Singapore, according to Triplemint’s James Michael Angelo, who represented her in the deal. Angelo said he initially offered $38 million for the unit — which drew a laugh from the marketing team — but only had to come up by $5 million to close the deal.

The 7,000-square-foot condo at 225 West 57th Street offers 360-degree views of Central Park and both rivers. There’s also a library, a private reception gallery and a 1,500-square-foot salon.

In June, Barnett acknowledged that the 57th Street supertall was going to fall far short of its $4 billion projected sellout, the Journal reported Thursday. Barnett added that he expected prices to appreciate at the building once construction wrapped in the next few months.

Closings began at Central Park Tower in February 2021. An October analysis by The Real Deal found that most units that had closed in the building had sold for far less than the prices outlined in Extell’s offering plan.

Across 33 closings that had hit public records by October, condos in the tower sold for an average of 25 percent less than their offering plan target on a per-square-foot basis, for 16 percent on a per-unit basis. Asked about the difference, Barnett called it “a basic fallacy” to describe the gap between sales prices and those listed in offering plans as a discount.

“We decided to go for sales velocity rather than maximum pricing,” he told TRD at the time. “I don’t see any downside.”

The project’s $900 million construction loan was set to mature in December and Barnett, who claimed to be “within striking distance” of paying it off, expressed a willingness to cut deals to get it done.

Read more

— Holden Walter-Warner