Through the winter and spring, rent hikes on Covid-era lease renewals soared as high as 50 percent as New York landlords cashed in on strong demand and low availability.

Those price bumps — largely a recovery from early-pandemic discounts — drove Manhattan’s average rent above $5,000, a near 30 percent jump in a year.

But new data show that landlords’ unprecedented repricing power has likely run its course.

In New York, a report by landlord rating site Openigloo found the average rent hike on a renewed lease was 11.2 percent in July. That’s down over 2 percentage points from June and was the fifth straight monthly decline since peaking at 22.5 percent in February.

“As we get to the last of the ‘Covid-deal’ renewals, increases have started to wane,” the report reads.

In July, just 9 percent of renewal leases carried a 21 percent to 30 percent hike, down from 14 percent in June. And the number of rent bumps north of 51 percent has flatlined to a mere 2 percent of renters. OpenIgloo’s findings are based on data from over 1 million users.

Read more

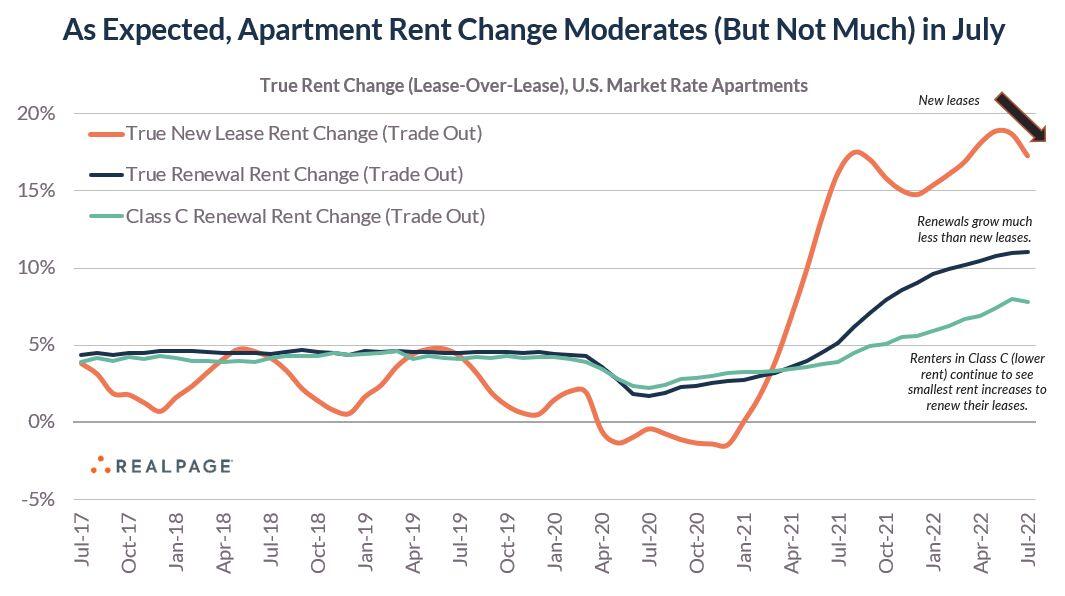

Nationally, price growth on renewed leases has posted a similar slowdown. According to rental analytics site RealPage, renewal increases have leveled off this year at around 10 percent or 11 percent after doubling in the second half of last year.

Chart via RealPage

That decelerating growth among reupped leases stems from an overall cooling of the rental market, Parsons writes.

For new leases, as opposed to renewals, landlords in July increased rents by 17.3 percent year-over-year, down from record hikes of nearly 19 percent in the month prior.

Apartment List’s most recent report backs that narrative. The rental platform found the median rent for a new lease in July rose 12.3 percent annually, down from June’s 14 percent and a far cry from 18 percent in January.

RealPage’s Jay Parsons (LinkedIn)

“I think we can safely say that peak rent growth is in the rearview mirror,” Parsons said. He added a key caveat: Rents are moderating only in respect to last year’s unmatched growth.

Or, as Apartment List writes: “So far this year, rents are growing more slowly than they did in 2021, but faster than they did in the years immediately preceding the pandemic.”

For Manhattan, the slowdown has yet to shake out: Its rents have continued to rise by an average of 25 percent, annually, from February through June.

But month-over-month growth rates have trended down since April. And if renewal leases are any indicator, July’s data will show a further decline.