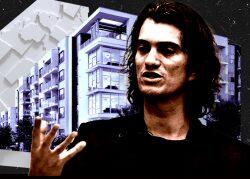

Adam Neumann is back in the real estate game with a new venture and a heavyweight backer.

The WeWork founder is set to launch Flow, a multifamily market venture, next year. The company has the backing of prominent venture capital firm Andreessen Horowitz, which has invested about $350 million into the company, the New York Times reported.

The investment from Marc Andreessen’s firm is the largest the company has ever cut for a funding round. Flow is valued at more than $1 billion, despite not yet officially launching.

Andreessen will be a board member of the venture upon its launch. In a blog post detailing the decision to invest, the investor lamented on tight inventory and wrote of a desire to disrupt the rental real estate market.

The announcement comes after the Atlantic reported Andreessen contacted local officials to oppose a proposed mutlifamily development in Atherton, a Bay Area suburb that encompasses the country’s most expensive zip code. The Times identified a slew of major tech and venture capital players opposed to the plan, which would contribute to the area’s compliance with state housing requirements.

For Neumann’s first post-WeWork venture, “the successes and lessons are plenty,” Andreessen wrote.

The first inkling of Neumann’s latest venture emerged earlier this year, when it the Wall Street Journal reported entities linked to Neumann purchased majority stakes in more than 4,000 apartments across the country. The holdings were valued at more than $1 billion and were located largely in Sun Belt markets, such as Atlanta and Nashville.

Read more

While details of Flow’s business plan are not public, Neumann plans to make a large personal investment in the startup through cash and real estate assets. The company will create a branded product with consistent community features and service across the portfolio.

Neumann stepped back from public life for some time after the implosion at WeWork, which forced him out of the company he co-founded. The company was once valued at $47 billion, but drama at the co-working giant resulted in a shelved IPO held until November, when it reported a loss of $802 million; its current market cap is just over $4 billion.

Neumann’s ouster from WeWork provided possible capital for next ventures. His exit package included a $245 million stock award, granted early in 2021. He also received $200 million in cash and had a $432 million loan refinanced.

— Holden Walter-Warner