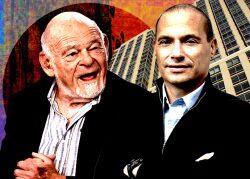

Five months after dropping a quarter of a billion dollars on a Riverside Boulevard apartment building, Doug Eisenberg’s A&E Real Estate nabbed financing for the 354-unit property.

Late last month, the firm secured a $188 million dollar mortgage from Los Angeles-based Mesa West Capital on 140 Riverside Boulevard, which it bought from Sam Zell’s Equity Residential in April, public records filed Monday show.

A&E declined to comment on the specifics of the loan, but its transaction record and a finger held to the macroeconomic winds suggest a first mortgage.

The property is one of three Upper West Side apartment buildings that were branded Trump Place until Equity dropped the moniker in 2016 shortly after former President Donald Trump’s election.

Two months after buying 140 Riverside Boulevard, A&E picked up neighboring 160 Riverside Boulevard in July for $415 million, bankrolling that purchase with a $286 million loan from Square Mile Capital.

Like the mortgage recorded this week, the financing covered about 70 percent of the closing price.

The third building in the collective, 180 Riverside Boulevard, is still owned by Equity, public records show. A&E declined to comment on whether it has been in talks to buy that property, too.

As for the lag between purchase and financing, it’s possible A&E chose to wait out the tumult of the spring mortgage market. The investor acquired 140 Riverside in April, a few weeks after the Federal Reserve first hiked interest rates.

On the heels of the bump, commercial mortgage rates spiked to 4.5 percent, a near percentage point higher than in the month before the increase, data from consultancy Select Commercial Funding show.

But because rates have risen even higher since then — as of this week, commercial mortgage rates stand around 5 percent — it’s unlikely A&E caught a lower rate in late August than it could have in April.

Records suggest some of the $188 million loan may finance repairs to the property. Late last week, the city approved plans for a lobby renovation. A&E also filed permits in June and July to renovate bathroom fixtures and appliances in a dozen apartments.

Eisenberg has spent the last several months on a multifamily buying spree extending far beyond the Upper West Side.

In April, the firm agreed to pay $250 million for 14 South Brooklyn rental buildings owned by the LeFrak Organization. And in February, A&E paid Long Island-based Benjamin Companies $130 million for a 22-building complex in Queens Village — the borough’s biggest multifamily deal since the start of the pandemic.

Read more