Nearly 50% of workers return to office post-Labor Day

Nearly 50% of workers return to office post-Labor Day

Trending

Office occupancy stalls after Labor Day push

Occupancy jumped in late August, but fewer than half of workers back in person

For the second straight year, Labor Day was cast as a flashpoint for post-pandemic office life. And for the second straight year, the holiday left properties feeling empty.

After a surge in occupancy post-Labor Day, attendance already appears to be leveling off, Bloomberg reported. Kastle Systems card-swipe data on the week of Sept. 21 show occupancy in New York City, the country’s largest office market, was down slightly from the previous week at 46.1 percent.

The stall came after occupancy surged by more than 10 percentage points in the two weeks between Aug. 31 and Sept. 14.

Transit use, an important barometer in commuter-heavy New York City, is also stalling. On Sept. 21, use of the Long Island Rail Road was at 71 percent of its 2019 average, maintaining the same level from the previous week. Subway ridership increased slightly between Sept. 14 and Sept. 21.

The picture is slightly more rosy nationally, at least in terms of occupancy. The average occupancy of 10 big cities tracked by Kastle Systems was 47.3 percent the week of Sept. 21, a slight drop-off from 47.5 percent the previous week. San Jose and Houston were among the cities recording occupancy increases.

Landlords trying to look at the glass nearly half full may find relief that occupancy didn’t crater significantly after the post-Labor Day push.

Offices across the city were emptied out during the pandemic, putting the properties in dire straits. At one point, occupancy was barely above 10 percent. It wasn’t until June that office occupancy hit even 40 percent in the city, and that didn’t prove to be a permanent accomplishment.

Read more

Nearly 50% of workers return to office post-Labor Day

Nearly 50% of workers return to office post-Labor Day

Office occupancy in New York finally hits 40%

Office occupancy in New York finally hits 40%

Tough decade at the office: Analysis predicts $500B value destruction

Tough decade at the office: Analysis predicts $500B value destruction

There’s a possibility, however, the September occupancy numbers may represent a new normal. More companies are settling into a wide range of work policies, whether that means calling back workers full-time, never or somewhere in between.

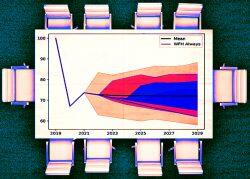

The pandemic-induced drop in office use is projected to have a devastating effect on the market. An analysis from a team at NYU and Columbia estimated that by 2029, the city’s office buildings will fall in value by 28 percent, or $49 billion.

— Holden Walter-Warner