New York City’s rental market appears to finally be cooling after a summer of historically high prices that was particularly difficult on middle-class workers.

Landlords were more likely to offer concessions and cut asking prices in September than July, according to data collected by StreetEasy. That comes as the citywide median rent has plateaued. In September, it was $3,500 a month, down from $3,575 in August.

“For many people, including essential workers, the rents in the summer were simply too high for them,” said StreetEasy economist Kenny Lee, who authored the report. “Soaring inflation has really hit those with lower wages and savings the hardest.”

Rents have been growing at a record pace just as inflation has significantly weakened wages. At the same time, high mortgage rates are pushing would-be buyers back into the rental market, furthering demand. But as an economist once famously said, if something cannot go on forever, it will stop.

Wages in August in New York City fell year-over-year by more than 9 percent after adjusting for inflation, per StreetEasy’s analysis of Consumer Price Index data, while real rents rose 13.4 percent year-over-year. Rent increases outpaced wage increases by 23 percent when adjusted for inflation.

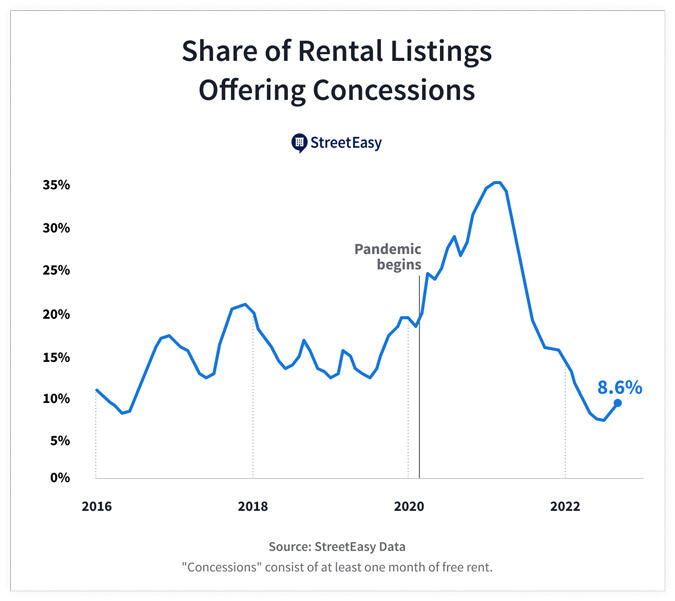

The market has come full circle since 2020, when lockdowns caused tenants to flee the city, forcing landlords to offer generous concessions and lower rents. But as demand for rentals returned, so did pre-pandemic rents.

More than a third of listings last quarter resulted from priced-out tenants, StreetEasy found, and asking rents rose 20 percent despite a 14 percent jump in available units, as landlords reacted to newfound interest in their apartments.

Read more

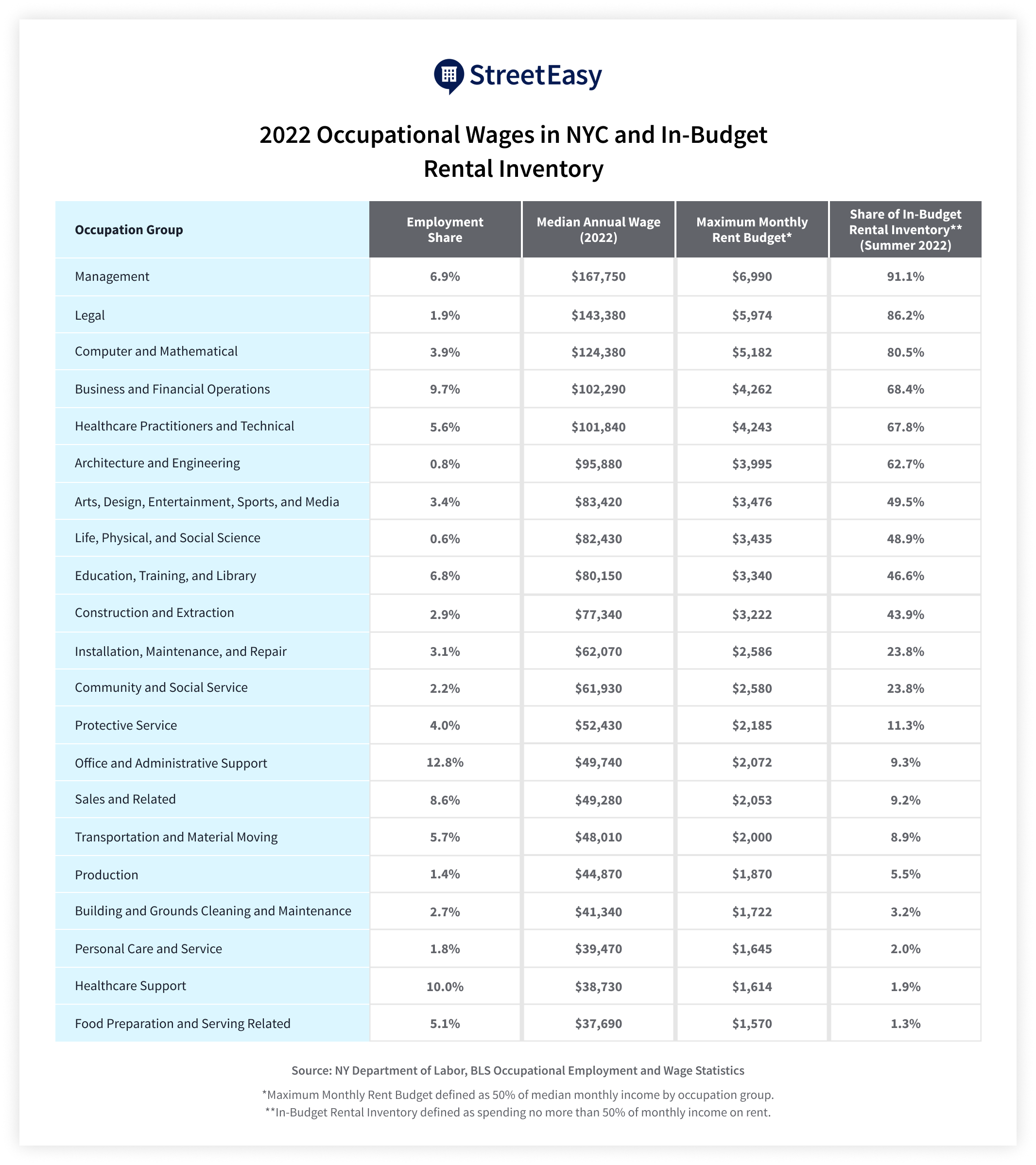

Almost half of the city’s 4 million workers were priced out of 90 percent of the rental market unless they spent more than half their income on rent, StreetEasy found. Health care practitioners could not afford roughly one-third of the market, while only 2 percent of inventory was within the budget of health care support staff.

Affordability is generally defined as no more than 30 percent of income spent on housing, although some have argued that the figure should be higher in transit-accessible neighborhoods.

It’s unclear if the market is cooling because of seasonality, which was disrupted by the pandemic, or if a wider reset is occurring. The rental market typically peaks in late summer before picking up again in the spring.

“The rebalancing of the market will likely take place at a gradual pace,” the report reads. “It remains to be seen whether demand cools beyond a seasonal slowdown toward the end of the year.”