Another inflection point has arrived for New York City’s developers and politicians, along with the victims of its housing crisis.

We knew it was coming: The $2 billion, 2,800-unit Innovation QNS project pitched by Silverstein Properties, BedRock Real Estate Partners and Kaufman Astoria Studios is nearly at the end of the time-limited public approval process.

The drama has been building for months, and on Friday, Politico reported a twist. The City Council member standing in the Astoria project’s way, Julie Won, asked her colleagues to back her up.

Why is that important? It’s an admission that she cannot kill the project on her own. Until recently, she would not have had to worry that her colleagues would override her.

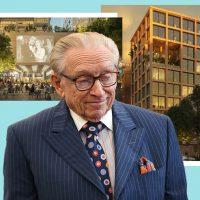

A rendering of Innovation QNS (Innovation QNS)

The Council tradition of supporting the local member on rezonings, called “member deference,” has always had exceptions. But they have been rare — after one in 2009 for Two Trees Development’s Dock Street Dumbo, there were none until a New York Blood Center vote last year — and generally are not made for projects such as Innovation QNS.

(Dock Street was 20 percent affordable, a first for Dumbo, and was endorsed by Letitia James, who represented the district right next to the project. It passed 40-9.)

What has changed in the past two months is that Mayor Eric Adams has started using his bully pulpit to call out people who block housing development, and Council Speaker Adrienne Adams publicly asserted that her chamber will not exacerbate the housing crisis by unreasonably rejecting projects.

Queens Borough President Donovan Richards went a step further Friday. In a blistering tweet, he essentially wrote that Won would be perpetuating segregation by killing the Silverstein/BedRock project, which would set aside 40 percent of units as affordable.

Black and Brown Queens residents deserve to live in Astoria. We were pushed out nearly a decade ago, because of no affordable housing production. I’m going all out on this ish!!!!! Neighborhoods like Jamaica and Far Rockaway have produced in Queens time and time again.

— Donovan Richards Jr. (@DRichardsQNS) October 14, 2022

Richards had opposed the project when it was 25 percent affordable, then backed it when developers made it 40 percent. Council member Won, who clings to the conspiracy theory that adding market-rate units will worsen the housing crisis, on Friday demanded 55 percent affordability from Innovation QNS.

To the untrained eye, it looks like Won wants even more integration in Astoria than Richards. But Richards’ 40 percent affordability is a bird in hand. Won’s 55 percent is two in the bush, meaning she could end up with no housing at all. It almost appears she would prefer that.

If rezoning required so much below-market housing as to make development unprofitable, the site would become worthless. That’s why developers withdraw applications rather than agree to such demands. They would be devaluing their land.

Read more

The Council has always been willing to override the local member on projects of citywide importance. But it’s taken a while for members to realize that adding housing in one district affects the whole city. Each project, even a $2 billion one, doesn’t move the needle much, but collectively they do.

By the same token, all the individual decisions to stop housing add up to a supply shortage.

It would be better, of course, if housing could be built without all these layers of review and political drama, which raise the cost of each apartment by about $70,000, according to a Citizens Budget Commission study. But outdated zoning across much of the city makes it necessary.

The de Blasio administration was only able to complete eight of its 15 proposed neighborhood-wide rezonings. Adams has not proposed any. Only developers have stepped up to the plate, submitting private applications to rezone and build more housing than the little or none otherwise allowed.

Of course they have a profit motive, but they also have risk. The expected return on investment must be large enough to justify the gamble of putting $2 billion into a project.

Julie Won is negotiating blindly: She doesn’t know what the expected return would be at 55 percent affordability. If the profit would be zero, obviously the project won’t happen. But it won’t happen at 4 percent either. Investors can buy 10-year Treasury notes and make 4 percent with zero risk. Why would they take a chance on building 2,800 apartments to make the same money?

People can’t live in Treasury notes. They need homes. Developers are willing to build them, generally for single-digit returns for their investors. It’s a pretty good option for New York. And right now, it’s the only one.