The demolition of the Hotel Pennsylvania is on track to be completed by the end of next year, but then what?

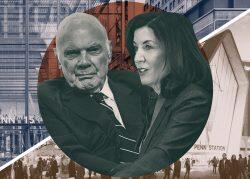

Vornado Realty Trust CEO Steve Roth cast doubt on its project Tuesday during the real estate investment trusts’ third quarter earnings call — yet also predicted a comeback for beaten-up office sector stocks, which he called “stupid cheap.”

“I must say, the headwinds and the current environment are not at all conducive to ground-up development,” he said.

When asked about the level of pre-leasing necessary to move forward with the office tower and if Vornado is considering non-office uses for the project, dubbed Penn 15, Roth opted to “duck” the question, in his words.

“In terms of changing uses and what have you, that’s not something that we are going to get into now,” he said.

Read more

Vornado is expected to be the developer of multiple sites surrounding Penn Station, as part of an 18-million-square-foot, mixed-use development. Critics have questioned the amount of office space planned, given uncertainty in the market and high vacancy rates. The Hotel Penn site was expected to be the first one developed.

Later in the call, Roth said Vornado is “absolutely, strongly convicted” about its plans for the Penn District, and is confident that companies and people will continue to flock to New York.

Vornado executives expressed a combination of confidence and caution when discussing the office market at large. Michael Franco, president and CFO, said the “bifurcation between high-quality and commodity product is growing,” as large tenants continue to demand new, amenity-rich Class A office space.

“As we enter the fourth quarter, though, caution is the word of the day,” he said. “There is increasing uncertainty in the world, and tenants are acting accordingly.”

When asked about investor sentiment around office REITs, Roth said their share prices will eventually recover. Vornado’s is down 47 percent this year and 68 percent over five years.

“What’s it going to take for you guys to start realizing that these stocks are stupid, stupid cheap? I don’t know, but it will happen,” the CEO said. “Just as the stock market always turns and gallops ahead way before the end of recessions, I think the office business will do so as well. I can’t tell you what the catalyst is.”

During the third quarter, Vornado’s funds from operations per share, a key earnings metric used by REITs, were $0.81 on an as-adjusted basis, higher than Wall Street’s expectations. Revenue also exceeded estimates, reaching $457.4 million in the third quarter, up from $409.2 million during the same quarter last year.

Roth said the REIT’s taxable income is expected to drop next year and as a result, the board will “right-size dividends” in 2023 (because dividend payouts are based on taxable income). He would not provide further details on the dividend adjustments.

Aside from work-from-home taking hold, the office sector has, like most others, been buffeted by rising interest rates. Vornado has reduced its exposure to floating-rate debt, entering into $2 billion worth of interest-rate swaps in the past nine months to guard against “runaway” interest rates.