Meridian Capital Group can re-enter Fannie Mae’s loan market.

Meridian announced on late Friday afternoon that Fannie Mae lenders can request quotes for Meridian-brokered loans.

The news means the brokerage is technically off of Fannie’s blacklist. It follows Freddie Mac’s decision last year to accept Meridian brokered loans.

But Meridian, a powerhouse commercial brokerage, announced few details in its announcement about Fannie’s move.

Meridian’s release from Freddie’s blacklist came with major caveats. Most notably, any lender would have to repurchase Meridian-brokered loans within a year of the loan’s origination if a borrower defaults, according to the Promote. In addition, lenders would have to vouch that each Meridian deal contained no fraud, the Promote reported at the time.

It is unclear if Fannie requires these same stipulations. Fannie did not return a request for comment.

The company was first placed on Freddie’s blacklist in late 2023 because of a suspect deal the company brokered. Freddie launched an investigation into the brokerage, and the firm put one broker on leave.

Fannie put Meridian on its own blacklist in March 2024. While the investigation was ongoing, Fannie and Freddie deals were off the table to Meridian brokers.

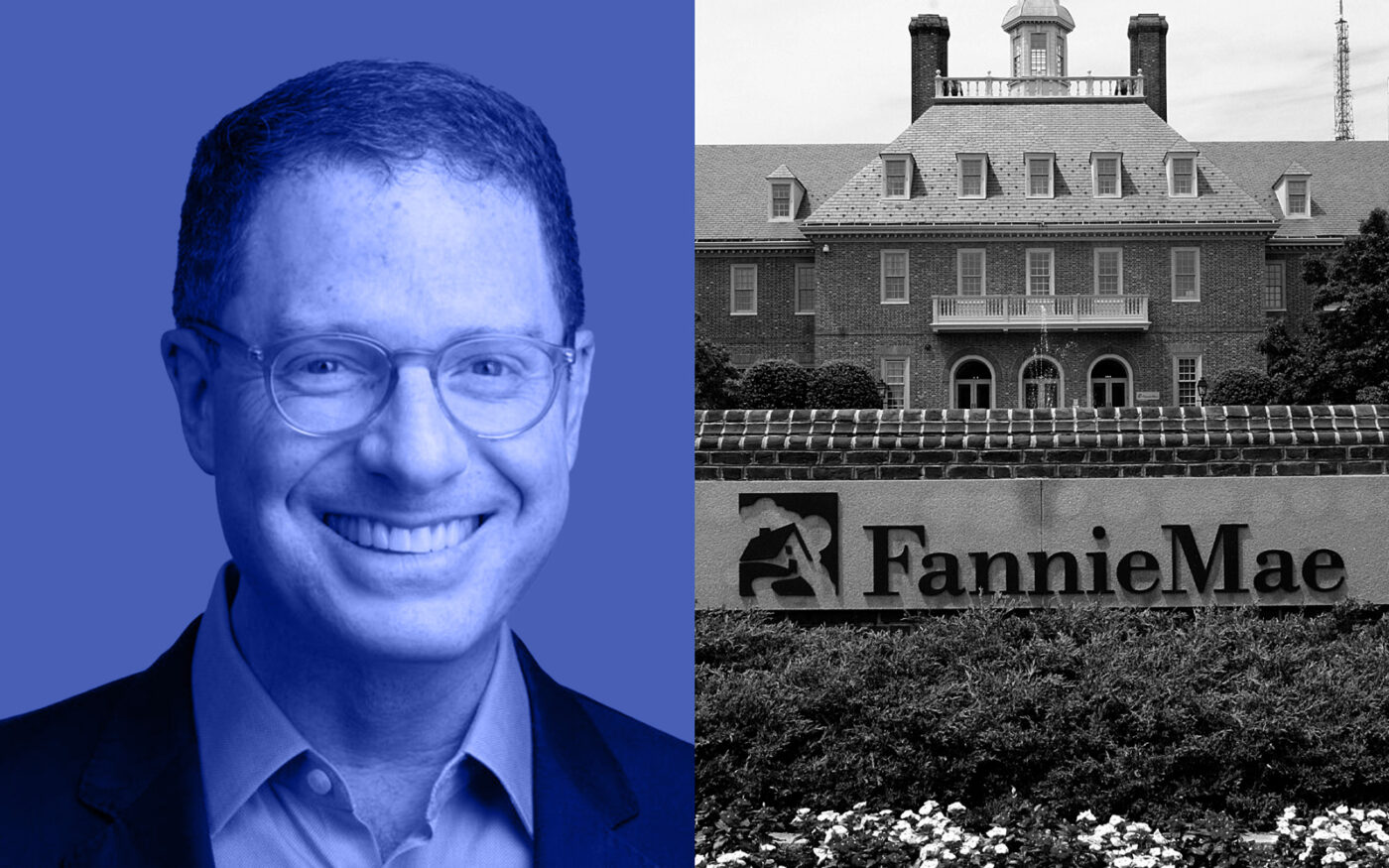

Since then, Meridian has undertaken a series of transitions and moves to revamp its internal controls. The company appointed Brian Brooks, a former general counsel at Fannie Mae, as its CEO. Ralph Herzka, who co-founded Meridian in 1991, moved into the senior chairman role.

The firm appointed its first chief risk officer, Melissa Martinez, the former chief risk officer of CoreLogic and OneWest Bank. Meridian cut 100 employees, according to the Wall Street Journal. Other prominent employees, such as Meridian’s president Yoni Goodman, left the firm amid its struggles.

Meridian also installed new underwriting processes, which require all Meridian-brokered deals to undergo a pre-screening process to ensure compliance and approval. In addition, the company developed a quarterly loan review process.

“Risk management is an enabler for our clients,” said Martinez in a statement. “The process oversight we have put in place will give lenders confidence that Meridian transactions have been carefully reviewed in a process that is as robust as you would expect from a bank.”

Herzka pushed the firm’s hard-driving work ethic and was known for the motto, “Eat. Sleep. Close. Repeat.”

Last year, Herzka spoke to a crowd at a real estate event in New Jersey and stressed the importance of loyalty.

“I learned who your friends are and who they aren’t,” said Herzka. “You can do something for someone for 20 years, and it doesn’t mean anything. And you can do something for no one, and all the sudden they are there.”

Read More:

https://therealdeal.com/new-york/2024/04/12/meridians-ralph-herzka-speaks-amid-probe/https://therealdeal.com/national/2024/10/09/freddie-mac-ready-to-embrace-meridian-again-with-a-catch/