Every day, The Real Deal rounds up Chicago’s biggest real estate news. We update this page at 10 a.m. and 5 p.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 5 p.m. CST

Marquette Companies plans major West Loop apartment project. The Naperville-based developer this week will present plans to build 512 apartments across three buildings in the booming West Loop. Under the plans, a 21-story building at 1400 West Randolph Street would house 252 apartments, while six- and eight-story buildings planned for the 1400 block of West Randolph would house another 250-plus apartments, as well as retail space. [Block Club]

Downtown condo buildings dominate luxury sales market. Last week’s top five residential sales were all recorded at newly constructed Downtown condo buildings. The sales show that condo sales continue to propel the luxury market, as suburban mansion sales fail to find buyers. [TRD]

Sterling Bay has unveiled a new street art installation at Lincoln Yards.

Sterling Bay unveils hidden street art at Lincoln Yards. The prolific developer is inviting the public onto its massive Lincoln Yards planned development site to find 26 pieces of newly-created street art. The installment is from local graffiti artist Merlot, whose “Alphabet Monsters” features 26 murals of each letter of the alphabet. [Chicago Tribune]

Industrial leasing is exploding. Warehouse leasing in the first quarter rose by 20 percent, with nearly 8.7 million square feet of space leased up. The leasing activity is continued good news for an industry with a strong pipeline of expected deliveries. [Rejournals]

Former Kraft Heinz exec will sell suburban mansion at loss. Eduardo Luz has listed his 5,500-square-foot Wilmette home at just under $2 million, less than the $2.1 million paid for the home in 2016. That’s not out of line with an incredibly sluggish suburban luxury market, which is dealing with a glut of inventory and a renewed buyer interest in Downtown condos. [Crain’s]

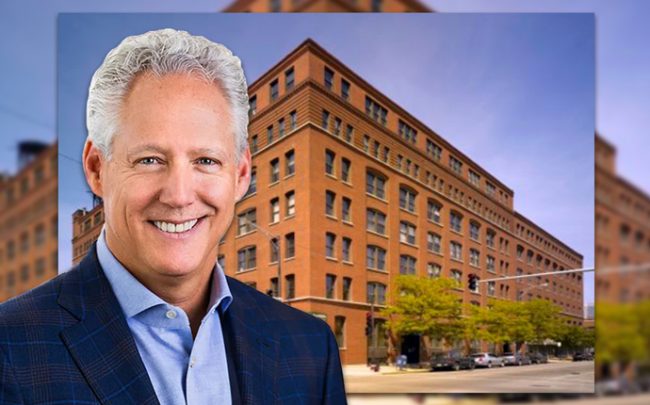

Tucker Development CEO Richard Tucker and 954 West Washington Boulevard (Credit: Tucker Development, Lindon Associates)

Tucker Development decamps for Fulton Market. The local developer is just the latest firm moving its headquarters to the bustling neighborhood. Tucker will take an unspecified amount of space at 954 West Washington Boulevard, which it has had an outpost since 2016. [TRD]

The labor shortage has taken a toll on some project timelines, or forced companies to pay workers overtime so they can meet their packed schedules. (Credit: iStock)

Construction industry struggles to find workers in development boom. With a number of megadevelopments on the to-be-built list, Chicago’s contractor firms, trade groups and unions are working to get more people in the construction industry. The problem is particularly acute in development-heavy Chicago, where the average age of construction workers is nearly 50 years old. [TRD]

The Fed has been chipping away crisis-era regulations, concerning some observers. In a process known as “tailoring,” the Fed has been incrementally tweaking regulations to improve the efficiency of regulations written during the crisis. “No individual thing jumps out, but if you look at the sum total, the direction of travel is not entirely encouraging,” a former Fed governor said. [NYT]

Chicago Opportunity Zone investing is a mixed bag. A new report by Renonomy shows that investing in the city’s Opportunity Zones has been muted, while values in the federal tax incentive areas have fallen. [GlobeSt]

Chicago Opportunity Zone investing is a mixed bag. A new report by Renonomy shows that investing in the city’s Opportunity Zones has been muted, while values in the federal tax incentive areas have fallen. [GlobeSt]

George R.R. Martin and 932 W. Margate Terrace (Credit: VHT Studios and Getty Images)

The former home of “Game of Thrones” author George R.R. Martin hits the market. The celebrated fantasy writer lived in this Uptown apartment in the 1970s after graduating from Northwestern. Since then, the unit has been converted into a condo, which is now on the market and will be shown this weekend in a special ‘Game of Thrones’ themed open house. [Block Club]

Naperville development gets pushback from neighbors. Tartan Realty Group is planning to develop a three-building commercial strip in the suburb that could include offices, stores and a drive-through coffee shop. The project requires city approval, but some neighbors are saying it would increase traffic and cause congestion in their area. [Daily Herald]

Downtown multifamily boom is cooling. Developers will deliver 9,000 Downtown apartments in the next two years, down from projections of nearly 11,000. This comes as rents in trophy apartment buildings has risen to a record $3.31 per square foot. [Crains]

CEO seeking to cash out of $10 million in homes. Michael Greenhill, the CEO of Smalley Steel Ring; and his wife Debra have listed a Highland Park mansion for nearly $7 million and a North Michigan Avenue condo unit at $3.3 million. The Greenhills could have a rough, given a soft luxury market particularly in the suburbs. [Crains]

The We Company is somehow worth 10 times as much as this public competitor. Office operator IWG, best known for its Regus brand, filed for bankruptcy after the dot-com crash. The firm’s experience has often been used as a point of reference for WeWork’s business model, as it nears its IPO. [WSJ]

A different set of benchmark rates inverted, hitting the real estate market. Three of the largest real estate investment trusts that buy up residential mortgages and package them into securities have cut their dividends so far this year. The cuts came after the yields on 3-month and 10-year treasuries inverted in March for the first time in over a decade. Last week’s inversion that sent the market into an uproar was on two-year and 10-year treasuries. [TRD]