Every day, The Real Deal rounds up Chicago’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 10 a.m. Please send any tips or deals to tips@therealdeal.com.

This page was last updated at 4:35 p.m. CT

Savills began marketing Takeda Pharmaceutical Company’s massive Deerfield headquarters to potential buyers this week. In April, The Real Deal reported that the company planned to sell the campus, cut 7 percent of their staff and relocate many of their employees. A buyer could have 1.3 million square feet of office space spread across 70 acres.

The Fulton Market is the fourth best place to live in the country, according to a ranking by Money Magazines. The magazine chose the neighborhood for its lower rent, home prices and new development. [Sun Times]

Real estate investor and developer Golub and Company acquired the 22-story, 585,000-square-foot Burnham Center. The company plans to add a fitness center, tenant lounge and conference center to the building. [Rebusiness]

Less than three months after Lululemon moved in, Acadia Realty Trust has sold their building on 938 W. North Avenue to New York-based developer Feil Organization. The developer paid over $30 million for the 31,000 square-foot building, they confirmed. [Crain’s]

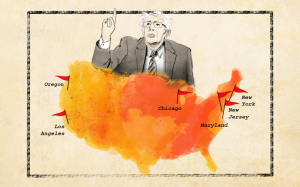

Across the country, tenant campaigns promoting rent caps just cause eviction legislation are gaining momentum. Presidential candidate Bernie Sanders has unveiled his own proposal for nationwide rent control. Illustration by Paul Dilakian

Battles against rent control bans in cities across the country are on the rise. In Chicago, a coalition of unions, community groups and the Democratic Socialist Organization have helped officials that have endorsed their “Lift the Ban” movement, to end Chicago’s rent control ban. [TRD]

Developer Sterling Bay bought the former C.H. Robinson building at 1840 N. Marcey St. for a price estimated to be more than its 2014 buying price at $9.5 million. The developer is already working on a Lincoln Yards project down the street from this property. [Crain’s]

In Glen Ellyn, Bear Peak Capital took out a $17.35 million dollar loan to convert 50 condos in the Iron Gate Apartment complex into multi-use housing. The loan was arranged by JLL. [REJournals]

Chicago trader is awarded millions after mismanaged real estate ventures. Ray Cahnman was awarded $8 million after his former business associate allegedly mismanaged his real estate ventures. The associate, David Zazove, must $7.7 million, and developer Stephen Barron has to pay nearly $500,000 for his role. The decision ends a case six-year-old case. [Sun-Times]

The Monaco hotel is for sale. Owner Xenia Hotels & Resorts is looking for a buyer for a portfolio of seven hotels, one of them being the 191-room Near North Side property at 225 N. Wabash Ave. The entire portfolio has an estimated value of $500 million. The Monaco was last sold in 2013 for $189 million. [Crain’s]

Forever 21 owes these five mall owners $20.9 million, bankruptcy court records show.

Mall owners on the hook from Forever 21 bankruptcy. The fast-fashion company, which occupies around 12.2 million square feet of retail space across the country — including several locations in Chicago — announced it would close 178 stores. Mall owners like Simon Property and Vornado are owed millions in lease payments. [TRD]

Work on Chicago’s Red-Purple line has begun. The $2.1 billion project, slated to be finished in 2024, includes the installation of a new signal system, wider platforms and an entirely new platform. It is one of the largest projects the Chicago Transit Authority has ever undertaken. [Curbed]

City planners are concerned the Standard Hotel construction will make traffic worse in the West Loop. Officials temporarily halted the project, at 1234 W. Randolph Street, until developers Marc Realty and DDG Partners present a plan to improve the situation. [Block Club]

Virtual brokerage eXp Realty is getting into the instant-homebuying game. The fast-growing firm said Thursday it will join the ranks of Redfin, Zillow, Keller Williams and Opendoor by offering sellers the chance to instantly offload their property to buyers. [TRD]

SoftBank’s debtholders hope for more caution. The cost to insure SoftBank’s debt increased last month to the highest level in nearly a year after WeWork’s IPO plans veered off track. But the co-working company isn’t all to blame: Uber’s valuation sagged, and SoftBank’s stake in Alibaba plummeted because of the trade war. [Bloomberg]