Trending

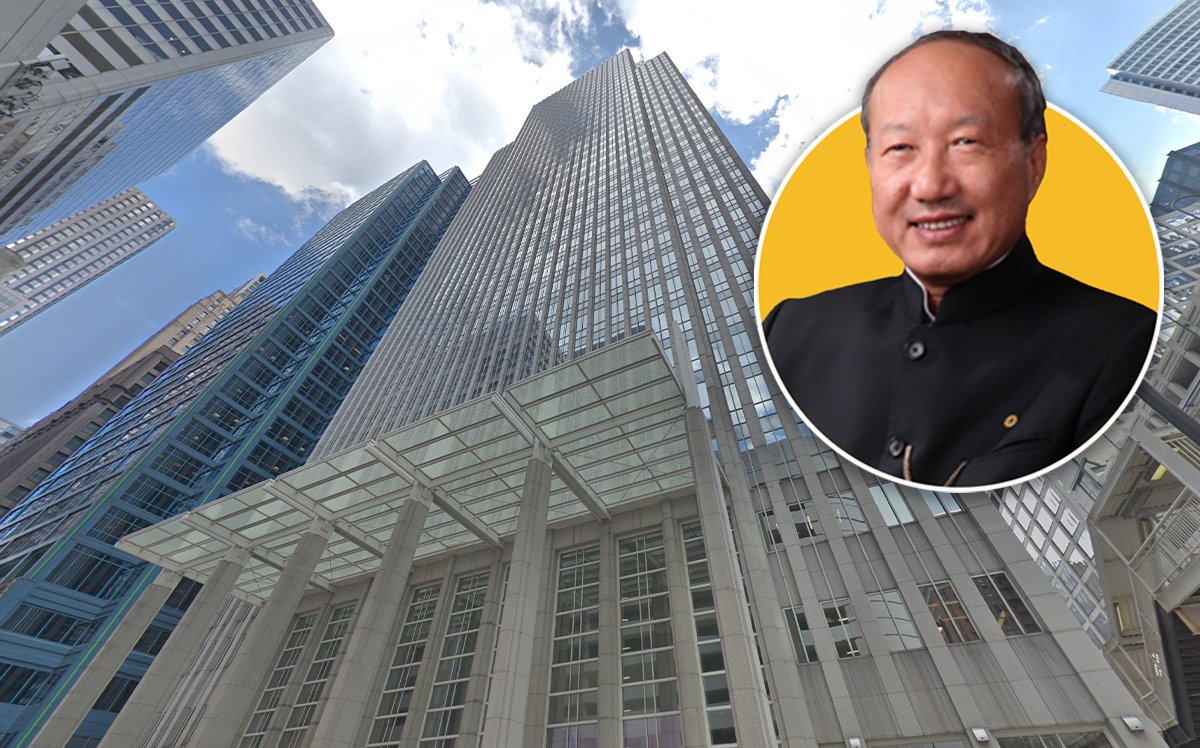

Embattled Chinese firm HNA Group refinances Loop skyscraper

Chinese conglomerate is refinancing the building that it bought for $359 million in 2017 and later tried to sell

After putting it on the market about two years ago, indebted Chinese conglomerate HNA Group has refinanced a 50-story office building in the Central Loop with a $240 million loan.

HNA Group received the financing for 181 West Madison Street from JPMorgan Chase, according to public records. It replaces a $233 million loan issued by MetLife in 2017, which was one of the year’s 10 biggest commercial mortgages issued in Chicago in 2017.

HNA Group bought the 937,000-square-foot building from CBRE Global Investors for $359 million in March 2017. It was one of Chicago’s 10 biggest investment sales of the year.

Less than a year later, HNA Group was seeking a buyer, Bloomberg reported. The building was only on the market for a short period of time before it was pulled, said a source familiar with the property.

In a similar move, prior owner CBRE Global Investors initially put the building up for sale in December 2015, and then refinanced with a $200 million loan from Wells Fargo Bank in February 2016.

In late 2017, amid an $86 billion-plus debt and liquidity crisis and pressure from the Chinese government, HNA Group began putting up scores of properties for sale. In its heyday, the one-time regional airline became the largest shareholder of Hilton hotels and Deutsche Bank AG. It also paid above-market prices for properties across the globe. In all, HNA spent $40 billion on global acquisitions.

In April, Bloomberg reported that HNA had sold off $25 billion worth of assets since early 2018. But even that wasn’t enough to stop creditors from seizing golf courses and other assets after one business unit missed a loan payment. HNA’s CEO Chen Feng wrote on the company’s WeChat page that 2020 would be “the decisive year to win the war” on its liquidity challenges, Bloomberg reported.

Northern Trust is the biggest tenant in 181 West Madison Street, where it occupies 400,000 square feet on a lease that runs through 2025. The building is currently 90 percent occupied.

HNA Group and MB Real Estate, which handles leasing for 181 West Madison Street, did not respond to requests for comment.