Forbearance requests appear to be leveling off, according to weekly figures released by the Mortgage Bankers Association.

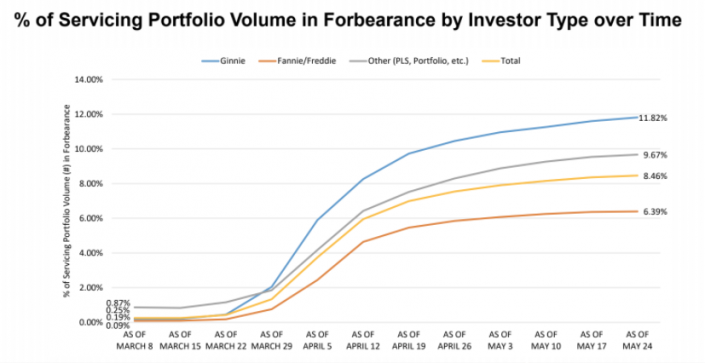

Mortgages in forbearance made up 8.5 percent of servicers’ portfolios for the week, up from 8.4 percent for the week ending May 17 and from 8.2 percent for the week before. That means roughly 4.2 million homeowners are now in forbearance.

The pace of new forbearance requests has declined for the last several weeks, and the last week of May continued the trend. Such requests accounted for 0.2 percent of servicing portfolio volume, marking the seventh consecutive weekly drop. The week prior, forbearance requests accounted for 0.28 percent of volume.

“Policy support for households, including expanded unemployment insurance benefits and other transfers, have helped many stay on their feet during this crisis,” MBA Chief Economist Mike Fratantoni said in prepared remarks.

Forbearance rates were considerably higher for some government-backed loans. Ginnie Mae-backed mortgages had the highest overall forbearance rate by investor type at 12 percent. Ginnie Mae guarantees home loans issued to lower-income borrowers by government agencies such as the Federal Housing Administration and Veterans Affairs. By contrast, only 6.39 percent of Fannie Mae and Freddie Mac loans were in forbearance.