Trending

Rent prices fall in college ZIP codes as remote learning rises

Student housing rents sank from May to August, and CMBS loan delinquencies on those properties jumped, according to Zillow

Numerous colleges nationwide began the fall semester by shifting to online classes only, which could precipitate a wave of distress for an asset class once considered to be recession proof: student housing.

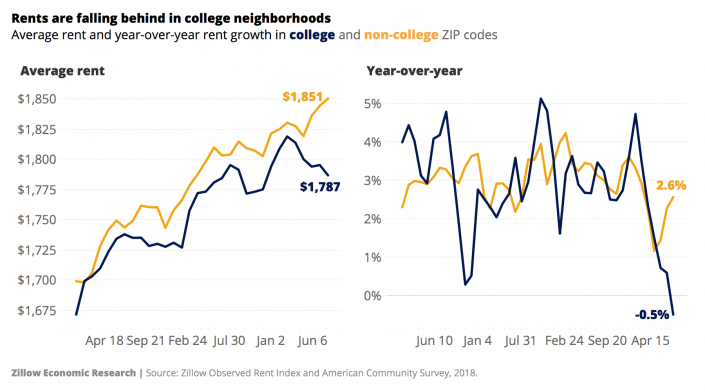

Rents in ZIP codes where college students make up at least 20 percent of the population dipped half a percent in August, compared to the same time last year, a Zillow study found. While that may seem unremarkable considering the U.S. just endured its worst GDP contraction on record, rent prices in noncollege ZIP codes rose 2.6 percent in August, year-over-year.

(Click to enlarge)

In May, average rent amounts in college ZIP codes were $19 lower a month than in noncollege ZIP codes, according to Zillow. By August, the gap had widened to $63 per month. The Zillow report notes that it’s possible the gap will widen even further as leases signed in 2019 expire over the next four months and are not renewed.

In February, before the coronavirus outbreak took hold, average rents in college ZIP codes were 4.6 percent higher than in February 2019, the report found.

The underperformance of student housing is likely to have ripple effects across the commercial real estate world, industry pros have said.

Student housing landlords often turn to commercial mortgage-backed securities loans to finance their acquisitions, construction and property operations. CMBS loans often offer lower rates and allow higher loan-to-value ratios than traditional commercial mortgages. They’re also typically riskier for borrowers because they include agreements with bondholders that make restructuring the loans more difficult.

Delinquency rates for loans backing student housing have exceeded multifamily delinquency rates for the last five four years. Still, the difference in loan performance between the two asset classes has never been more pronounced than now, according to a recent Trepp report.

The share of student housing-backed mortgages whose borrowers were at least 30 days past due on payments reached an all-time high of 13.7 percent in July. The delinquency rate for multifamily-backed debt was only 2.2 percent in the same month.

The drop in revenue flowing from student housing may lead public universities and private colleges without major endowments to sell off assets, sources told The Real Deal last week.